Zero base budget

The origin of the concept

The idea of zero-based budgeting originated in 1952, American Wayne Lewis proposed a budget in his article, "A New Interpretation of the preparation of the budget theory" in preparation the new arguments.

That is in the preparation of public expenditure budget, based on what standard or method to determine the amount of funds allocated to certain sectors A, B and not allocated to the department, assigned to the department A to department B may not assign What produces different results. He believes that this problem can be resolved only through "non-traditional methods of preparation." This kind of "non-traditional method of preparation" is the zero-based budgeting to be formed later.

development history

20 1960, the US federal government Department of Agriculture has tried to pilot zero-based budgeting in this department, but ultimately fruitless.

1970, the US Texas Instruments personnel research department in the department budgeting successful use of zero-based budgeting, after which all departments of the company in the preparation of the budget have successfully adopted a zero-based budgeting. Subsequently, the first zero-based budgeting will be widely promoted in the private sector of the United States. Soon the US federal government had decided to use zero-based budgeting in the public sector, Georgia became the first state government uses zero-based budgeting method.

1979 Carter was elected US president in the federal government to fully implement according to zero-based budgeting approach to the preparation of the public sector budget, many state governments have to follow, zero-base budgeting meteoric rise, spread rapidly in the United States. After that, a number of other governments of the world are starting to adopt.

zero-based budgeting declining trend in the late 1980s, in 1993, the US Congress enacted the "Government Performance and Results Act", has begun to adopt new performance budgeting.

traditional budgeting

method steps

1, the extrapolation of past trends in spending (or prior year expenditure) be extended to next year.

2, the amount will be increased, as appropriate, in order to adapt to labor costs and increasing raw material costs and wages caused by inflation.

3, will increase the amount of Zaiyu to meet revise the original plan and budget expenditures original design modifications required additional, usually in this area of 30% or more of the original budget.

essence of the assumption

1, last year for each item of expenditure are necessary, and they are to achieve organizational goals and mission essential.

2, the necessary last year for each item of expenditure in the next year there is still continued, and compared with other new programs or new programs more necessary.

3, last year each of the items of expenditure were all at a cost-effective way to implement the largest.

4, last year for each item of expenditure next year will still need to, at best, only on labor costs and raw material costs which make some adjustments. Results

Results Effect

in such a step, on the assumption that the budgeted amount, inevitably tends to occur, and the risk of the following:

1 , the beginning of each budget year, more than the units of actual expenditure basis, and then additional sum of money, after smartly decorated, submitted as a new top leadership plan approval;

2, presided over the leadership of budget approval , knowing that the budget of "water", but do not fully understand the situation, only good and bad, regardless, will be cut by 30% (or more), then began a quarrel process;

3, after a period of after time, budgeting is completed. Almost all have views of the applicant are, we all feel this way must be reformed, but year after year, there is still not much improvement;

4, this indiscriminate white cut knife practice, the experienced staff intends to finance the budget made so much longer than necessary, so that after the "cutting knife" can meet the need, but for those who honestly made for the budget complain incessantly. Fortunately, live and learn a lesson, when the reconstruction budget go astray. As a result, nothing more than encouraging subordinates to deceive superiors. For the preparation of the traditional method, the US Texas Instruments Peter · A · Phil (Beter A. Pyhrr) proposed in 1970 a "zero-based budgeting" (Zero-Base Budgeting, abbreviated as ZBB) concept. US government departments, in particular the Government of Georgia, the earliest use of ZBB, and achievements. Subsequently, the organization adopted accordingly.

zero-base budgeting

Modern preparation of the budget after the bourgeois revolution to victory, with the establishment of modern budgetary system gradually formed.

17 century, Britain developed the world's first national budget, to the 20th century, most countries have established national budgeting system. Meanwhile, budgeting also undergone many changes. Since the early government budget content relatively simple, using very simple budgeting "functional budgeting."

With the tremendous development of social productivity, the content contained in the government budget gradually increased, in order to meet this need, and gradually formed a relatively complete the budget process, including modern budgeting, such as "plans and performance-based budgeting" (performance budgeting), "project-based budgeting" (project budget) and so on, quite a few countries in the world to use "zero-based budgeting" (zero-based budgeting) .

algorithm steps

zero-base budgeting has the following five steps:

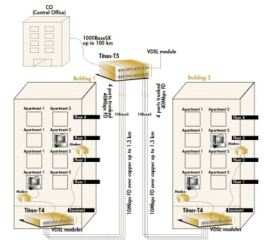

1, division and determine the primary budget units grass-roots enterprise business units generally be considered as the basic unit independent budgeting.

so-called "budget unit" is not the same unit on the daily life of meaning, put it plainly, it refers to the money where it is needed, departments, projects, activities and so on. How to determine the budget units in the end, the designer of zero-based budgeting did not make hard and fast rules, the key is to look at the budget on which level. After determining the budget units, followed by the development of a basket making.

2, the preparation of the unit budget plan

by the company raised the overall goal, then the grassroots budget units starting in accordance with the overall objective of the enterprise and their own responsibility goals, preparation of the unit achieve these goals of budget programs, the purpose of the project proposed, the nature, role, and the amount of the fee required spending must be stated in the protocol in detail.

3, a cost-benefit analysis

primary budget units issued by "operational budget year program of activities", the project and its operational expenses need to be confirmed in the budget period, the management of expenses and income required for each project gains a comparative analysis, balance, distinction level, to draw level, to single out one after another. Primary budget units operational projects are generally divided into three levels: the first level is the necessary items that can not be non-progressive project; the second level is the need to project that helps improve the quality and efficiency of the project; third level is to improve project working conditions. The purpose of cost-benefit analysis is to determine the reasonableness of the budget expenses of the grassroots units of each item, the order and the impact on the business activities of the unit.

4, review the allocation of funds

According to the level, rank and order of the budget, according to the budget of available funds and their sources, according to the prioritization of projects, the allocation of funds to implement budget.

5, the preparation and implementation of the budget

After determining the allocation of funds, on the development of zero-based budgeting formal draft, after approval is issued for implementation. In case of deviation from the execution of local budgets must be promptly corrected, special cases should be promptly corrected, in case of budget problems of their own to find out why, lessons to be improved.

advantage

1, will help improve the "input-output" awareness.

zero-based budgeting is "zero" as a starting point the observation and analysis of all business activities, and does not consider the level of past expenditure, therefore, need to mobilize companies of all staff involved in budgeting, so that irrational factors We can not remain down, begin to reduce waste from investment, through cost - benefit analysis, to improve the level of output, thereby enabling the input-output awareness is enhanced.

2, conducive to the rational allocation of funds.

Each business through cost - benefit analysis, whether there should be for each business project, spend some, to be analyzed and calculated, careful planning and capabilities, can make limited capital flows fruitful project, funds allocated can be more reasonable.

3, that will help the grassroots units involved in the creative budgeting.

zero-based budget preparation process, the internal situation easy communication and coordination, overall business goals become more specific, multi-service project priorities easy to get a consensus, the initiative will help mobilize grass-roots units involved in budgeting , enthusiasm and creativity.

4, help to improve budget management.

zero-based budgeting greatly increased the transparency of the budget, the head of special funds and budget expenditure glance, quarrels between all levels of the phenomenon may ease the budget will be more realistic, will be better afford to control the role, preparation and implementation of the entire budget can be gradually standardized, budget management will be improved.

disadvantages

Although there are many good innovative zero-based budgeting method and compared to traditional budgeting methods, but there are still some "bottleneck" in the practical application.

1, due to the all the work from "zero" to start, so a large amount of the preparation of zero-based budgeting method, the cost is relatively high;

2, layered, sort and funds the allocation, may affect subjective, prone to conflicts between departments;

3, any unit of work items "priorities" are relative, too much emphasis on projects that may be relevant personnel to focus only on short-term interests neglect of the unit as a whole, long-term interests.

Latest: German choice