What Are the Essential Features of a Financial Data Center?

Financial data centers play a critical role in ensuring the smooth functioning of financial transactions and services. They provide the infrastructure necessary for processing vast amounts of financial data securely and efficiently. Understanding the key features of financial data centers, such as top-notch security, scalability, and eco-friendly operations, is essential. Let’s explore how these data centers support secure financial operations and meet industry regulations.

High-Level Security Standards in Financial Data Centers

Physical Security Protocols

Physical security in financial data centers is paramount. To protect sensitive information and critical infrastructure, these data centers employ multiple layers of security. Measures include restricted access to authorized personnel only, biometric authentication, 24/7 surveillance cameras, and on-site security guards. These protocols ensure that only those with proper clearance can enter high-security zones, protecting critical data and systems from physical threats.

Cybersecurity Measures

Financial data centers must guard against a wide range of cyber threats. This includes employing firewalls, intrusion detection systems, and encryption technologies. Regular security assessments, penetration testing, and real-time monitoring help identify and mitigate potential vulnerabilities. This proactive approach is crucial in maintaining the integrity and confidentiality of financial data, preventing data breaches, and ensuring compliance with security best practices.

Compliance with Financial Regulations

Compliance with financial regulations such as GDPR, PCI DSS, and SOX is non-negotiable for financial data centers. These regulations set the standards for data protection and privacy. Compliance is achieved through rigorous audits, maintaining comprehensive records, and implementing robust data management policies. Adhering to these regulations not only mitigates legal risks but also builds trust with clients and stakeholders, reinforcing the data center’s commitment to security.

Scalability and High Availability for Financial Services

Flexible and Scalable Infrastructure

Scalability is key for financial data centers to handle increasing volumes of transactions and data. Utilizing modular design and virtualization technologies allows these centers to quickly scale storage, computing power, and networking resources. This flexibility supports the dynamic needs of financial institutions, enabling them to adapt to market demands and process transactions without disruptions.

Redundant Systems for Maximum Uptime

Ensuring maximum uptime is critical. Financial data centers deploy redundant systems, including power supplies, network connections, and hardware components. These redundancies enable seamless failover in case of system failures, ensuring continuous operation. Regular testing and maintenance are also conducted to verify that backup systems function correctly and reliably at all times.

Disaster Recovery and Business Continuity

Proactive disaster recovery planning is essential. Financial data centers implement comprehensive business continuity plans that include data backups, offsite data replication, and geographic redundancy. These measures ensure that, in the event of a disaster, financial services can be restored rapidly with minimal data loss, protecting the institution’s reputation and maintaining customer trust.

Efficient Cooling and Energy Management in Financial Data Centers

Advanced Cooling Solutions for Optimal Performance

Maintaining optimal temperatures is vital for the performance and longevity of data center equipment. Financial data centers employ advanced cooling solutions such as precision air conditioning, liquid cooling, and hot/cold aisle containment. These technologies efficiently manage heat dissipation, preventing overheating and ensuring that servers and other hardware operate within ideal temperature ranges.

Energy Efficiency for Sustainable Operations

Energy efficiency is a priority. Financial data centers leverage energy-efficient hardware, renewable energy sources, and power management strategies to reduce their carbon footprint. Implementing these practices not only supports environmental sustainability but also lowers operating costs, making the data center more economically viable while aligning with global green initiatives.

Robust Network Infrastructure and Data Connectivity

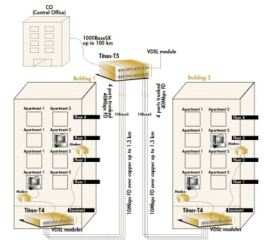

High-Speed and Low-Latency Connectivity

High-speed, low-latency connectivity is essential for real-time financial transactions. Financial data centers invest in high-bandwidth fiber optic networks and redundant internet connections to ensure fast data transfer rates. The resulting low latency minimizes transaction times, enabling financial institutions to execute trades and process payments swiftly and efficiently.

Secure Data Transmission and Storage

The secure transmission and storage of data are fundamental. Encryption protocols for data in transit and at rest, coupled with secure networking technologies, protect sensitive financial information from interception and unauthorized access. Regular security updates and access control mechanisms further safeguard data integrity throughout its lifecycle.

Integration with Cloud and Hybrid Environments

Many financial data centers are now integrating with cloud and hybrid environments to enhance their service offerings. This integration enables financial institutions to leverage cloud computing’s scalability and flexibility while maintaining control over sensitive data. Hybrid solutions also facilitate seamless workload distribution and optimize resource utilization, creating a robust and resilient data management ecosystem.

Conclusion

Financial data center plays a crucial role in the financial industry by offering secure, scalable, and efficient infrastructures. Through high-level security measures, regulatory compliance, redundancy systems, and energy-efficient operations, they ensure smooth and reliable services. As the financial sector evolves, these data centers continue to adapt, integrating innovative technologies to meet the growing demands. Their robustness guarantees the safety and availability of critical financial data, empowering institutions to operate confidently and sustainably.

Latest: Modular UPS vs. Standalone UPS: Which Is Better for Your Business?

Next: What Are the Key Benefits of a DCIM System for Data Centers?