Basic introduction

Definition 1 Forebell Variable Also known as policy variables, refers to an external factor in economic mechanism, not inside the economic system The variable determined by the factors. It can affect endogenous variables, but it itself is a variable determined by an external factor that is constantly studied by an economic model. Such variables can usually be controlled by policy control, as a variable of its policy objectives.

Definition 2 The foreign variable refers to the economic relationship of the study of research in Western measurement economics, but it is not affected by these relationships. Therefore, it is a variable that is determined other than the economic system. For example, when studying a country's total economic activity, export statistics are usually seen as a foreign variable. In my country, the total import and export not only affects accumulation, but also has an important impact on total investment.

Exogenous Variables is a measurement economy, meaning the argument in the countd economy model. In the Connecting Equation Model

represents the foreign variable, it is independent of the disturbance item, the foreign variable is outside the economic system The factors are determined, and its change affects the changes in the system.

Economic Measurement Model

Economic Measurement Model The random economy mathematical model consisting of specific equations. The equation is: , represents the demand for some item, represents the individual disposable income of residents. and are called " Economic Variables ", that is, to describe the amount of economic activity or economic phenomena and the amount of numerical variations. In the formula, the variable y is called " interpretable variable ", the value of the value is caused by changes in other variables (X) in the model; variable X is called " interpretation variables ", the variation of its value does not depend on changes in other variables in the model, but independently. and are called " parameter ", which is a normal coefficient of the number of variables in the model. The parameters connect various variables in the model, and specifically indicate that the interpretation variable is the extent of the interpreted variable. is called " random disturbance" ", indicating the impact of various random factors on the model, reflecting the impact of various factors in the model. The economic metering model is a mathematical expression consisting of the relevant variables, corresponding parameters, random disturbances, by reflecting the causal relationship between economic variables.

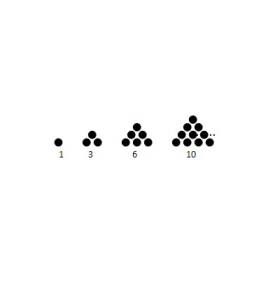

If we collect the historical statistics (actual values) of the variable , you can calculate the parameter A of the above model with a certain method. And b. The calculation of the model parameters is called " parameter estimation ". The commonly used method of estimation model parameters is " minimum multiplier ". This method can enable the normal value of the estimated variables calculated by the model to the difference in the difference in the actual value, that is, the estimated value of the interpretable variables calculated by the model can be made closer to its actual value. The data points of the explanatory variable Y corresponding to the interpreted variable Y corresponding to different levels are given in FIG. The straight line in FIG. 1 is a straight line that is calculated by the interpreted variable Y as the interpretation of the variable value of the variable X after the parameter estimation. This line fitted the original actual value, that is, the actual value of the interpretable variable is returned to an estimated value in the average meaning. This analysis method that quantitatively described the causal correlation between variables is referred to as " regression analysis ". The economic measurement model set for regression analysis is called " regression model ". The estimator of the estimated value of the regression model and the degree of regression fitting of the actual value of the interpretation variable is referred to as " determination coefficient " or " can be determined ". The determination coefficient is between 0 and 1, the closer to 1, indicating that the degree of fit the regression model is better. The returns and parameters are referred to as " linear regression model " in linear forms. The linear regression model containing only one interpretation variable is called " unitary linear regression model " or " Simple linear regression model ". A linear regression model containing more than one explanation variable in a equation is called " multi-linear regression model ". In a plurality of linear regression models, there is no linear correlation between each interpretation variable. This model is called " multi-aramnarity " said that the model is called " multiple copies" ". This will affect the accuracy of the estimation of model parameters. Therefore, when the multi-linear regression model is established, there is a need to avoid multiple common linear problems on the selection of the variable. Use only one equation to describe a model in which the variable variable change in the economic relationship is called " unilateral model ". The model of multiple interpretable variable changes in the economic relationship is used to describe the model of the various interpretable variables in the economic relationship is called " Multiode Model ". The multi-echelm model containing the endoric variable in the interpretation variable is called " loice equation model ". In the loop equation model, variables are divided into two categories: one is as the endogenous variable of the interpreted variable, that is, its value is determined within the model of the set economy system. The endogenous variables are the results of the solution to solve the model. Another category is the of the interpretation variable , ie the value has been given before the model is solved. The prodence variable includes exogenous variables and lag variables of endogenous variables . External variable is a variable determined outside the model of the set economy system, The lag variable is a certain variable time lag. In the above model, if the variable x does not take the previous value, the previous value of the individual can dominate the residents has a lag, the previous value of the personal disposable income of the residents is called " Lag variable ". In the economic model, the foreign variables can be divided into policy variables and non-policy variables . Policy variables, also known as " controlled foreign variable " means a foreign variable that can be controlled by decision makers; non-policy variables, " non-controllable foreign variable " It means that the decision maker is difficult to control or cannot control the foreign variables.

Related Concepts

Economic mathematical model is generally represented by an equation or equation group consisting of a set of variables, and variables are the basic elements of the economic model. Variables can be distinguished into endoous variables, external variables (External variables) and parameters. In the economic model, the endogenous variable refers to the variables to be determined by the model. The foreign variable refers to a known variable determined by the factors other than the model, which is an exterior condition that is established. The endogenous variables can be explained within the model system, Outer variable determines the endogenous variables, and the foreign variable itself cannot be explained within the model system. The parameter is a variable that is usually unchanged, and it can be understood as a variable constant. The parameters are usually determined by factors other than models, and parameters are often seen as a foreign variable.

Endose variable is also known as non-policy variables, due to variables, refers to variables determined by pure economic factors within the economic mechanism, not about policy. The endogenous variable is determined by the model system, but also affects the model system, such as the price, interest rate, exchange rate, etc. in the market economy.

parameter is a variable whose index value is usually constant, and it can be understood as a variable constant. The parameters are usually determined by factors other than models, and parameters are often seen as a foreign variable.

example: indicates the relationship between the price and quantity, the is the parameter, all foreign variables; is a model To determine the variable, it is an endogenous variable. In addition, the price of related items, other variables related to models, etc., are exogenous variables.