Financial futures market

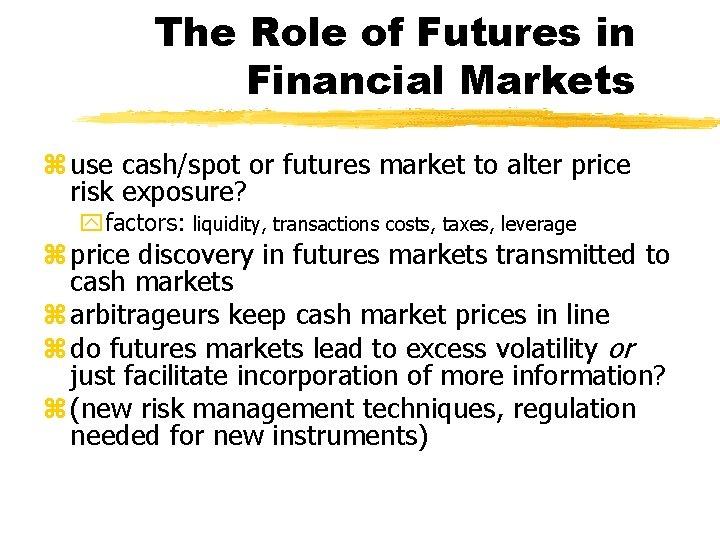

Basic functions

In general, the successful operation of the financial futures market price discovery and risk transfer two functions. The so-called price discovery, refers to the results of a variety of financial futures traded on commodity contracts in the exchange system is capable of generating such financial futures commodity. Futures market price discovery of financial assets has three characteristics:

impartiality

Since futures trading is centralized on an exchange, but the exchange as an organized, standardized unified market, a large concentration of buyers and sellers to form price through an open, fair and just competition. It basically reflects the real supply and demand and trends

anticipatory

compared with the spot market, futures market prices to predict future changes in market supply and demand, it can domestic market prices combined with international market prices together organically. Futures market price significantly improved the quality of information, the supply and demand to get long-term display and adjustment, the futures market information is an important basis for business decision-making and national macro-control.

economic life all the time there is no risk, and futures markets have a risk transfer mechanism, it can provide hedging operations, to minimize the risk of price fluctuations. Hedging is to buy or sell a considerable amount of cash and positions in the opposite direction of futures contracts, with a view to a future - time price risk by selling futures or buying units and about compensate for the spot market price changes brought about. Since the seventies, sharp fluctuations in the world economy, financial risks surge, financial institutions and companies seeking to avoid the risk of financial futures market, which is the financial futures market to generate intrinsic motivation development.

The reason why the financial futures market has the function of risk transfer, mainly because there are a large number of speculators to participate in the futures market. They are based on market supply and demand changes in a variety of information, to predict price movements, by buy low and sell high profit. It is these speculators assume the market risk, creating market liquidity, the futures market risk transfer functions can be smoothly achieved.

transfer risk

From the origins of the financial futures of view, because since the 1970s, frequently exchange rates, interest rates, volatility, exacerbated by the overall inherent risk capital goods. Investors face the increasingly widespread impact of the wave of financial liberalization, to avoid interest rate risk on the objective requirements, exchange rate risk and price volatility risk of financial assets and a series of financial risks, financial futures markets precisely in response to this demand and to establish and developed . Therefore, to avoid risks is the primary function of the financial futures market.

investors through the purchase of related financial futures contracts, establishing quite opposite direction spot position and the number of futures contracts in the financial futures market, with a certain time or by selling futures contracts to buy in the future compensate for the spot market price changes brought about by the price risk. From the financial futures market, which is to avoid the risk function has been able to achieve, mainly because it has the following characteristics:

First, the characteristics of the current uncertain financial futures have transformed the uncertainty of forward transactions, traders can trade futures contracts, lock-in costs or profit, in order to reduce operating and investment risks.

Second, the futures price and the spot price of financial products generally in the relationship between changes in the same direction. Due to the large number of arbitrageurs financial futures market, if the difference between the spot price and the futures price of financial products, namely base difference is greater than the cost arbitrage, arbitrageurs would Admission arbitrage operations, making the futures price and the spot price and consistency convergence. Investors in financial markets after the establishment of a financial futures market, spot opposite position, when the price of financial products are changed, it is inevitable in a market profitable, damaged in another market, its profit and loss can be offset in whole or in part, in order to the purpose of avoiding risks.

Third, the financial futures market through a standardized exchange-traded, has a large number of speculators. Only hedgers of futures trading market is unlikely to reach equilibrium, due to the presence of speculators, bear the market risk, the counterparty to become hedgers, which makes the futures market risk transfer functions can be smoothly achieved. By speculators frequently, making a lot of trading financial futures market has a strong liquidity in the financial futures market, hedgers can realize the transaction in a timely manner on acceptable price, which is relative to the long-term futures trading main advantage.

Price ability

financial futures market price discovery function, refers to the financial futures markets can provide valid price information about various financial products. John C.Hull (1999) believed in efficient markets, financial futures price is expected future spot prices of non-biased estimates. Long-term financial futures market price formed to provide useful reference information for other related markets, which helps to reduce search costs and negotiation costs and improve transaction efficiency.

Related Features

financial futures markets have effective price discovery mechanism is associated with its own characteristics: first, the financial leverage of futures trading, low transaction cost characteristics, it It has a better, more effective price discovery mechanism. Leverage allows traders to greatly reduce the capital cost of ownership, coupled with low transaction costs, making traders total transaction costs are relatively lower cost cash transactions, such as in the United States, the total transaction costs of financial futures investments only spot transaction costs 1/7 or so. According to the principle of transaction costs, lower transaction costs, the easier the formation of the equilibrium price, therefore, in this environment of low transaction costs, financial contract prices of financial futures market formed closer to the equilibrium price than spot trading prices.

Second, the financial futures market a good short-mechanism. While some spot market can be short, but more limited, high cost; and the futures market due by hedging open positions before delivery, so short is very convenient, and low cost. Short mechanism allows investors to fully implement the relevant information to the futures price, without having to suffer at the time of sale, the hands must be restricted spot, which also makes futures contract prices better reflect the variety of information than the spot price.

Third, due to the financial futures markets have leveraged the benefits of low transaction costs and the environment, attracting a large number of information traders have some kind of information. They exchange this organized, centralized, on regulated market, the transaction price determined by auction is similar to the way this case is close to perfectly competitive market. Although not everyone's price expectations are unbiased, but due to the large number to reach equilibrium price that is the real equilibrium price. Therefore, the price of a financial futures contract, can be integrated to reflect the degree of influence of various factors on the financial market of the underlying commodity contract, have open and transparent features.

is a strong four prospective. Futures long-term delivery, making futures prices reflect expectations and long-term supply and demand of financial products to financial investors in commodity prices considerably. This prospective financial futures price higher than the spot market price significantly improved the quality of price information, making the participants in the futures market, according to the forward price, to adjust their economic activity, reduce economic volatility.

Futures effect

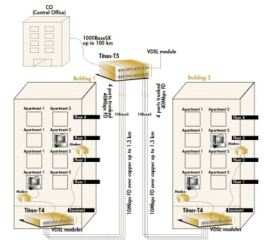

The vast majority of investors in futures trading are traded through futures companies, therefore, the company is actually a futures stock index futures intermediaries. Futures companies will charge a transaction fee to the trader at the time commissioned by the customer on behalf of investors to trade.

financial futures market (3) the main functions and role of

futures companies are: (1) trading futures contracts in accordance with customer instructions, handling billing and settlement procedures; Futures accepted by customers engaged in futures trading, expanding the range of market participants, expanding the size of the market, saving transaction costs and improve transaction efficiency, enhance competition in the futures market fully, contribute to the formation authoritative and effective futures prices. (2) for customer account management, customer transaction risk control. (3) provide customers with the stock index futures market information, trade counseling, acts as the client's transaction advisory services.Latest: Erythromycin ointment

Next: Outstanding cooperation