Brazilian freshwater valley company

Basic Information

Brazil Freshwater Valley Corporation (Vale of Brazil) (Vale, full name: Companhia Vale Do Rio Doce) Abbreviation Vale. The Brazil Dadui Valley was founded on June 1, 1942.

Brazilian Danshuihe Valley Iron ore production accounts for 80% of the total production of Brazil.

Operation

Brazilian freshwater valley company 2006 hair revenue reached $ 20.4 billion, a year-on-year increase of 52%. Pure profit reached $ 6.5 billion, a year-on-year increase of 52%. The company's 2006 mineral production has recorded history records, iron ore and balls reached 2.76 million tons, 3.2 million tons of alumina, 4.85 million tons of aluminum, 169,000 tons of copper, 733,000 tons of potassium, 1 million tons of kaolin. Brazil's David Valley's business operations account for a proportion of countries and regions around the world: 29.0% in Europe, 27.5% Brazil, 12.4% in China, 8.9% in Japan, 4.8% of Asia, 13.0% from other countries in the world. In 2007, the iron ore wasulated 295.9 million tons.

In addition to operating iron ore sand, the Brazilian Detwater Valley also operates manganese mine sand, aluminum mine, gold mineral products and pulp, port, railway and energy. The company began to implement privatization and a merged mineral sand enterprise on May 7, 1997. At the beginning of 2000, the Daduihe Valley not only acquired Socoimex, but also all the shares of Samiti mining.

In December 2018, the world brand laboratory released the "2018 World Brand 500" list, and Ranked 393th in David River Valley.

Development Plan

Brazilian Dry River Valley company mineral mining development plan is global, including: mining coal, aluminum soil, copper, iron and diamonds in Venezuela; mining in Peru; Aluminum and copper; in Chile mining aluminum and copper; Argentina exploded potassium, aluminum and copper; in Gabon mining manganese; mining coal, aluminum and copper in Mozambique; exploiting diamonds, aluminum, copper, potassium and iron in Angola; exploiting in Brazil; Aluminum, copper, nickel, white golden mine; manganese, diamond, kaolin and aluminum; in Mongolia mining aluminum, copper and coal; mining coal, copper, aluminum and aluminum in China.

Product Service

David River Valley Iron ore production accounts for 80% of the total production of Brazil. Its iron ore resources are concentrated in the "iron Tour" area and Bala State in the north of Brazil, with a Bobei Belt iron ore, Ka Pennimer iron mine, Karagas iron ore, etc. Its main mineral can be maintained for nearly 400 years.

Management team

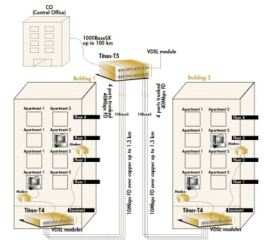

The Brazilian Detwater Valley has 5 offices in the world, which has established offices in China in 1994; in 15 countries, regional business operations and minerals Mining activities; investment projects in China; project feasibility is undergoing projects in 2 countries.

Company Development

Entering International Nickel Industry

Brazil Daduirhe Valley Mining Company issued a publication on October 24, 2006, said company has used cash The price of 86 Canadian dollar (about 76.90 US dollars) acquired 75.66% of the Canadian International Nickel Industry. Deli River Valley is the fourth largest mineral company in 2006 with sales scale. After completion of the acquisition transaction of $ 15.8 billion, the freshwater river valley will become the world's largest nickel producer and second only to Australia. Billito company. The world's second largest mining group. In his publication, Dadui River Valley said that the company plans to acquire all current shares issued by the Canadian International Nickel Industry. In order to join the remaining shareholders of the International Nickel Industry Company to join the acquisition plan, the Dadui Valley company extended the purchase period to November 3. All of the Nickel Valley of Danshui River Valley need to spend $ 17.2 billion, which will be the largest acquisition in the world's mine industries, and also the largest M & A case in the 74-year-old.

Enter the Chinese market

One of the three major mining giants of the World, Brazilian Freshwater River Valley, in order to compete for the Chinese market, began to expand from a simple ore trader role to industrial investment home. On January 27, 2008, the Brazilian Daduihe Valley Mining Company announced that a new palliac mine plant was established in Zhuhai, which is its first ore business investment in China.

It is far from China's road to China's road. It has always been the disadvantage of the Brazilian Danshui River Valley relative to other two other mine giants in Australi and the Indian mining enterprises. To this end, David River Valley is ordering the amount 400,000 tons of large iron ore transport boats, named "China", will become the world's largest iron ore transportation ship, which can greatly reduce the transportation cost of iron ore.

March 18, 2016, Brazil David River Valley signed a long-term transportation agreement with China Ocean Maritime Group in Beijing. According to the agreement, in the next 27 years, China's mine transport will be about 16 million tons of iron ore ships shipped every year in David River Valley.

Maintain a long-scale minimum mechanism

After the beginning of the iron ore negotiation in 2008, the Australian Mine Enterprise must have proposed to change the iron ore negotiation mechanism and establish similar other resource products. The daily index system does not just rely on the negotiations opposite the end of each year, and another big mining giant Rio Tinto is announced to sell some iron ore to the spot market. Both are because they see the spot market and long-term The huge price space of the contract negotiation price. David River Valley believes that the long-term price mechanism is the most favorable for supply and demand, and hopes for a long time.

Oman Jian Factory

May 8, 2008, Brazilian Mining Giants Signed an agreement with the Oman Suhar Industrial Port Company, will invest about $ 1 billion in Suha Harbor construction an iron ore processing plant and distribution center. Daduir Valley company plans to transport iron ore from Brazil to Suhar Port, and then processed iron ore into a ballite in its processing plant, and transported the product to the Middle East through the distribution center of Suhar Port.

This plan of the freshwater valley company has been approved by the company's board of directors, so Suhar Port Iron ore processing and distribution project will become the first steel industry greenhouse investment project in the freshwater river corporate in Brazil. The Freshwater Valley Company is expected to be put into production in the second half of 2010 in the second half of 2010. Suhar Port is located 240 kilometers northwest of Muscat, Amando, with approximately 20 square kilometers, planning construction of petrochemical, metallurgy, and logistics.

Critical Financial Crisis

Brazil Mining Giants Freshwater Valley Company confirmed on December 3, 2008, in order to address the financial crisis, the company has laid a worldwide 1,300, and arrange 5,500 employees The collective vacation, and the other 1200 people receive off-road training. 20% of the cut personnel, 80% of the vacation personnel concentrated in Minas Geras, southeastern Brazil, and other people's distribution is unclear. Deli River Valley said that the above measures have been implemented in November, and the above measures have been implemented in the company, according to the plan, the last group of vacationers will return to work in March 2009. After the outbreak of the financial crisis, it was influenced by the steel industry, and the Dadui Valley Company announced the reduction of iron ore by 30 million tons in October and reduced some of the production of countries such as France, Norway, China and Indonesia.

Iron ore negotiation

June 10, 2009, Dadui Valley Company announced that it has completed the 2009 financial ore price 2009 fiscal iron and South Korea Puchi iron negotiation. David River Valley announced that the price reduction of iron ore with Nikiite and Pohang iron, the price of powder contracts will be lowered by 28.2% in fiscal year, and the price of blocking is 44.47%, and the price of the ball is 48.3%.

China Steel Association requires that iron ore raises at least 40% compared with the 2008 base price, and may exit the current iron ore pricing system for 40 years, because the steel plant has begun to start development The market seeks to supply the supply.

Brazilian Miners David Valley said on June 7, 2009, refused to provide a bigger discount, indicating that if China does not accept the existing iron ore base quasi-based price to negotiate with other Asian steel mills, they have to withdraw from the current system.

Enterprise Honor

In July 2018, "Wealth" World 500 Rankings released, Brazil Dadui Valley Company ranked 325th in the "2018" Fortune "World 500" Bit.

In December 2018, the world brand laboratory released the "2018 World Brand 500" list, and Ranked 393th in David River Valley.

In July 2019, "Wealth" World 500 has released 336 bits of the Brazilian David River Valley company.

May 13, 2020, David River Valley ranked 2020 Forbes Global Enterprise 2000 Issue 513.

On August 10, 2020, the Brazil Valers ranked 333th in the world's 500-world list of 2020.

In May 2021, the Danshui River Valley is a "2021 Forbes Global Business 2000" No. 113.

The latest dynamic

September 6, 2019, Vale.us and Yantai Port Signing Framework Agreement will provide high quality iron ore to the China and Asian markets.

February 11, 2020, the four-quarter iron ore production decreased by 22.4% year-on-year, and sales fell by 3.2% year-on-year.

February 21, 2020, freshwater river valley (Vale.us) Q4 net loss is $ 1.56 billion, the stock price fell over 1%

Latest: Eisen House Plan

Next: Third party evaluation