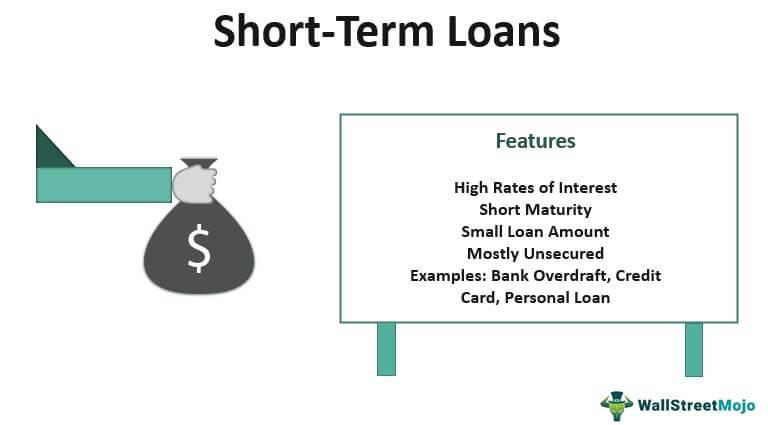

Bank Short-term loan

defined

Short-term bank loans for a period of three months to a year (can be referred to as "short-term loans", "short-term loans"), with house mortgage is also possible. The current bank loan interest rates generally in about 6%. All types of banking institutions, can be handled, such as workers and peasants in the establishment of diplomatic relations large commercial banks, investment, Societe Generale, Shanghai Pudong Development and other joint-stock banks and city commercial banks and rural financial institutions around.

defined

loan interest rate in accordance with the People's Bank of China interest rate policy and lending rate floating range, depending on the nature of the loan, currency, purpose, manner, duration and risks to determine where interest rates for loans and floating rate into a fixed rate. Loan interest rate in the loan contract note, customers can inquire at the time of applying for a loan. Overdue loans required additional penalty. The advantages of short-term loans is relatively low interest rates, money supply and repay more stable. The disadvantage is that enterprises can not meet the long-term funding needs, while, due to the short-term loans with a fixed interest business interests, may be affected by interest rate fluctuations.

short-term loan contract

Guarantor:

Legal address:

Address:

Lenders: < / p>

address:

Given ------------ (slightly under "borrower") and the lender in years ---- ---- January ---- signed a loan contract [ID:]

(slightly under "Loan agreement"), to protect the lender claims to achieve, and as the borrower to make withdrawals under a loan contract item conditions precedent, now People's Republic of China in accordance with relevant laws and regulations, based on the principles of equity, after consultation with the parties agreement, conclude this contract are provided for compliance.

First, under this contract are guaranteed the principal claim is based on contract ------ loans provided to the borrower by the lender (currency) ----- yuan a whole (amount in words ) of the loan principal, the guarantor in this recognized as valid evidence borrower's debt owed to the lender issued by business operations subject to the provisions of accounting documents; the maturity date is May --- ---- ---- Year - date, the contract term "expires (expiration)" includes a case the lender announced the loan in advance of maturity.

Second, the warranty guarantor of the borrower under the contract all due and payable without payment of principal and interest under the loan contract, liquidated damages, damages, attorney's fees realization of claims, legal fees and other related costs.

Third, the alleged contract guarantee severally liable, the guarantor of the debt owed by the borrower and the borrower jointly and severally liable under warranty. Borrower due and payable all outstanding debt, the guarantor shall be unconditionally as the primary obligor to pay off the lender, and hereby authorizes the lender plans received directly from the guarantor bank in the XXXX business institutions to open savings accounts, or from other financial institutions to open about plans to close the account in accordance with law.

Fourth, to ensure that under the contract are independent, irrevocable, continuing guarantee. This warranty is not affected by the main contract validity of the contract, the loan contract is not invalid, revocable invalid, revocable. Not because the guarantor's responsibility to ensure that public lenders to roll over loans, restructuring, or the lender and the borrower to change the loan agreement and the contract has changed, not because of any change in the behavior of their own business or management system of the borrower and the guarantor may change. The lender and the borrower to change the loan contract or agreement to roll over loans, restructuring or change the borrower's own business or management system, without obtaining the written consent of the guarantor, the guarantor should also bear guarantee responsibility. Day

five witnesses during the guarantee under this contract, the principal debts expiry date of two years. The loan was declared early maturity considered the primary debts expires, the lender may at any time request the guarantor to ensure the guarantee period to assume responsibility, the guarantor shall bear guarantee responsibility. Consent of the lender extension, restructuring of loans agreed during rehabilitation to ensure that the main guarantor of debts two years from the date of expiry of the period.

guarantor to bear within the warranty period under this contract guarantee responsibility. The borrower fails to perform their obligations in accordance with the provisions of the loan contract, over a period of guarantee, the lender may require the guarantor to assume the guaranty liability. During the lender does not require performance guarantee guarantor of debt, the guarantor exempt from guarantee responsibilities.

Six, during the card, the lender will legally transfer the principal debt to a third party, the guarantor of the original pledge to continue to assume responsibility within the scope of the guarantee. Within the guarantee period, without the written consent of the lender and the guarantor, the borrower may not transfer the debt.

Seven guarantor makes the following representations and warranties to the lender, the statements made at the time of signing the guarantee, and remain in effect during the period the contract is valid.

(1) the guarantor is incorporated under the laws of China in accordance with corporate or other economic organizations, have full rights of all its assets, with full civil capacity, external independent bear civil liability.

(2) the guarantor has authorized, have signed this contract, the terms of this contract are the guarantor of true meaning, legally binding on the guarantor. Any contract

(3) guarantor execution and performance of this contract does not violate the guarantor shall comply with laws, regulations, rules, judgments, rulings and orders, nor guarantor of the constitution or the signed agreement or any other obligations conflict.

(4) the guarantor guarantee issued by all financial statements are in line with Chinese laws and regulations, statements give a true and fair indication of the financial situation of the guarantor; all documents and information in this contract involved are true effective, complete and accurate without any concealment.

(5) the guarantor is not hide has occurred or any impact is going to happen or likely to affect the lawsuit his signature or performance of this contract, or may have a material adverse impact on its business and financial condition, arbitration cases, administrative procedures, events, property preservation measures, enforcement proceedings or other significant adverse effects. During

Eight, to ensure that, as guarantor of further commitments to the lender:

(1) guarantee business law, and actively cooperate with the lender to supervise and inspect their operating conditions, according to the loan people require timely financial statements and other relevant information to the lender.

(2) to ensure that the lender without the written consent of the constitution and not without major changes in the scope of business, not allowed to sell, rent, transfer or otherwise dispose of all or most of their assets; also no unauthorized change their business management or operation system and perform other acts affecting the interests of the lender, that is sufficient to produce significant adverse impact on its financial position or its ability to perform its obligations under this contract.

(3) to ensure that its obligations under this Contract status at least not less than its other obligations not provided security interest, and now and in the future not to sign any resulting warranty obligations under this Contract contract or agreement in a subordinate position. When

(4) ensure that once that has been or on its financial position or its ability to perform its obligations under this Contract significant adverse effects may occur the fact that within three days notice in writing to the lender.

(5) the guarantor for the replacement of the legal representative, authorized representative, change address, business name, or a significant change in the financial, personnel matters, within three days notify the lender in writing.

(6) the timely payment of all accounts payable, and obligations under this contract. Under

Nine, after the commencement of this contract, if contrary to the country issued by the relevant laws, rules and regulations, to ensure the lender loans the safety and effectiveness of the premise, the contracting parties shall promptly signing of a supplementary contract to be Complete.

X. This contract shall enter into force after both parties stamped signature or seal and various legal representative or authorized to borrowers in the debt under the loan contract termination fully repaid, but:

when the date of entry into force (1) If the date of the signing date of the signing of this contract prior to the main contract, the contract signed in this session to the main contract.

(2) the borrower ahead of the return of all loans, this contract should be extended to six months after the termination of early repayment date, unless the parties otherwise agreed in this contract. The borrower fails to prepay the entire loan, the borrower does not repay the debt, the guarantor shall still bear the guarantee responsibility.

XI of this law applicable to the contract People's Republic of China, any dispute relating to this contract are subject to business loans to take charge of the local people's courts shall have jurisdiction.

12. This contract is made in duplicate, each party holds one signed copy of the number of copies for future reference.

In the legal implications of signing the contract amount, the parties to all the terms of the contract and the parties had no doubt about the rights, obligations and responsibilities of the terms are accurate understanding.

guarantor (seal) the lender (official seal)

legal representative or authorized representative (signature or seal) legal representative or authorized representative (signature or seal)

Bank account no:

signing date: May ---- ---- ---- on day

latest interest rate

people's Bank of China, from July 6, 2012, within six months benchmark lending rate 5.60%, 6 months to 1-year interest rate of 6.00%.

Latest: Material scope

Next: Assembly line