Accounting

Method

Accountingmethodisamethodusedforcomplete,continuousandsystematicreflectionandsupervisionofaccountingobjects(accountingelements),mainlyincludingthefollowingseven.

Settingupanaccounttitle

Settingupanaccounttitleisamethodofaccountingforthespecificcontentclassificationofaccountingobjects.Theso-calledaccountingsubjectsareitemsthatclassifyandcalculatethespecificcontentofaccountingobjects.Settingupaccountingsubjectsistospecifytheseitemsinadvancewhendesigningtheaccountingsystem,andthenopenaccountsintheaccountbooksaccordingtothem,recordvariouseconomicoperationsinaclassifiedandcontinuousmanner,andreflecttheincreaseinvariousaccountingelementscausedbytheoccurrenceofvariouseconomicoperations.Reducechangesandresults,andprovidevarioustypesofaccountingindicatorsforeconomicmanagement.

Double-entryaccounting

Double-entryaccountingisamethodofaccountingthatissymmetricaltosingle-entryaccounting.Thecharacteristicofthismethodisthatanequalamountmustbecreditedtotwoormorerelevantaccountsatthesametimeforeacheconomicbusiness.Throughthecorrespondingrelationshipoftheaccount,youcanunderstandtheinsandoutsoftherelevanteconomicbusinesscontent;throughthebalancerelationshipoftheaccount,youcancheckwhethertherecordsoftherelevantbusinessarecorrect.

Fillintheauditvoucher

Accountingvoucherisawrittenproofthatrecordseconomicbusinessandclarifieseconomicresponsibilities,andisthebasisforregisteringaccountbooks.Vouchersmustbereviewedbytheaccountingdepartmentandrelevantdepartments.Onlytheaccountingdocumentsthathavebeenreviewedanddeemedtobecorrectcanbeusedasthebasisforbookkeeping.Fillingandreviewingaccountingvouchersnotonlyproviderealandreliabledataforeconomicmanagement,butalsoanimportantaspectoftheimplementationofaccountingsupervision.

Accountbookregistration

Accountbookisabookusedtocomprehensively,continuouslyandsystematicallyrecordvariouseconomicoperations,andisanimportanttoolforkeepingaccountingdata.Registeredaccountbookisthebrokeragebusinessthatrecordsaccountingvouchers,whicharerecordedintherespectiveaccountssetupintherelevantbooksinatimelyandclassifiedmanner.Theaccountbookmustbebasedonvouchers,andtheaccountsshouldbesettledandreconciledregularlyinordertoprovidecompleteandsystematicaccountingdataforthepreparationofaccountingstatements.

Costcalculation

Costcalculationreferstothevariousexpensesincurredinthecollectionanddistributionofcertainobjectsintheproductionandoperationprocess,andthetotalcostandunitcostoftheobjecthavebeendeterminedAspecializedmethod.Throughcostcalculation,thepurchasecostofmaterials,theproductioncostandthesalescostoftheproductcanbedetermined,andthevariousexpensesincurredintheproductionandoperationprocesscanbereflectedandsupervisedwhetherthecostissavedorexceeded,andtheprofitandlossofthebusinesscanbedeterminedbasedonit.

PropertyInventory

PropertyInventoryreferstoamethodofkeepingtheactualaccountinaccordancewiththeactualinventoryandcheckingtheaccounts.Throughpropertyinventory,itispossibletofindoutthesafekeepinganduseofvariouspropertymaterialsandmonetaryfunds,aswellasthesettlementofexchangefunds,andtosupervisethesafeandreasonableuseofvariouspropertiesandmaterials.Duringtheinventorycheck,iftheactualamountofpropertymaterialsandmonetaryfundsisfoundtobeinconsistentwiththebookbalance,thereasonshouldbeinvestigatedintime,processedthroughcertainapprovalprocedures,andtheaccountbookrecordsshouldbeadjustedtoensurethatthebookamountisconsistentwiththeactualdepositamounttoensureaccountingThecorrectnessandauthenticityoftheaccountingdata.

Preparationofaccountingstatements

Accountingstatementsarepreparedonaregularbasisbasedontherecordsoftheaccountbooks,andcollectivelyreflectspecifictimepoints(month-end,quarter-end,year-end)andacertainperiod(monthly,Quarter,year)writtendocumentsoffinancialstatus,operatingresults,andcostsandexpenses.Theinformationprovidedbytheaccountingstatementsisnotonlyanimportantbasisforanalyzingandevaluatingtheimplementationoffinancialcostplansandbudgetsandpreparingthenextfinancialcostplansandbudgets,butalsoanecessaryreferencematerialforeconomicdecision-makingandcomprehensivebalancingofthenationaleconomy.Theabove-mentionedaccountingmethodsareinterrelatedandcloselycoordinatedtoformacompletemethodsystem.Intheaccountingmethodsystem,intermsofitsworkingproceduresandworkingprocess,therearemainlythreelinks:fillingandreviewingvouchers,registeringaccountbooksandpreparingaccountingstatements.Duringanaccountingperiod,theeconomicoperationsthatoccurmustbeprocessedthroughthesethreelinkstoconvertalargenumberofeconomicoperationsintosystematicaccountinginformation.Thisconversionprocess,thatis,fromfillingandreviewingvoucherstoregisteringaccountbooks,tocompilingaccountingstatements,isthecycleofchangethatisgenerallycalledtheaccountingcycle.Thebasiccontentis:Aftertheeconomicbusinessoccurs,thehandlingpersonnelmustfillinorobtaintheoriginalvouchers,andaftertheaccountingpersonnelreviewandsortthem,usethedouble-entryaccountingmethodaccordingtothesetaccountingtitlestopreparetheaccountingvouchersandregistertheaccountingbooksaccordingly.;Tocalculatethecostofvariousexpensesincurredintheproductionandoperationprocessbasedonthevouchersandaccountbookrecords,andverifytheaccountbookrecordsbasedonthepropertyinventory,andregularlyprepareaccountingstatementsonthebasisofensuringthattheaccountsareconsistent.

Accountingisthebasisofaccountingwork.Accountingmustcomplywiththe"AccountingLawofthePeople'sRepublicofChina"andrelevantfinancialsystemregulations,meettherequirementsofrelevantaccountingstandardsandaccountingsystems,andstrivetoensurethataccountinginformationistrue,correct,andComplete,guaranteethequalityofaccountinginformation.The"AccountingLawofthePeople'sRepublicofChina"clearlystipulatesthatthefollowingmattersmustbehandledthroughaccountingproceduresandaccounting:

(1)Receiptandpaymentoffundsandsecurities;

(2)Receipt,increase,decreaseanduseofproperty;

(3)Occurrenceandsettlementofcreditor’srightsanddebts;

(4)Increaseordecreaseoffundsandincomeandexpenditureoffunds;

(5)Calculationofincome,expenses,andcosts;

(6)Calculationandprocessingoffinancialresults;(7)Othermattersthatneedtogothroughaccountingproceduresandaccounting.

Functions

Theaccountingfunctionofmodernaccountingisnotonlythepost-reflectionofeconomicactivities,butalsoincludespre-accounting,in-processaccountingandpost-accounting.

Themainformofpre-accountingistomakepredictions,participateinplanning,andparticipateindecision-making;

Themainformofin-eventaccountingistointerveneineconomicactivities;

Themainformsarebookkeeping,reimbursement,andsettlement.

Practicingqualification

AccountingPracticingCertificateisanecessaryqualificationforaccountingpersonneltoengageinaccountingwork,andtheonlylegalvalidcertificaterequiredforaccountingpersonnel.Itisthethresholdforaccountantstoentertheaccountingindustry.Territorialmanagement,universalthroughoutthecountry.Accountingqualificationcertificateisalsoaprerequisitefortheexaminationofaccountingtitles.

Contentrequirements

Thecontentofaccountingreferstotheaccountingitemsthatshouldbehandledintimeforaccountingproceduresandaccounting.The"AccountingLaw"hasstipulatedthebasiccontentofaccounting.Article37ofthe"Specifications"reiteratedthisprovisionofthe"AccountingLaw",whichrequiresthatthefollowingaccountingmattersmustbehandledinatimelymannerandaccountedfor.

1.Receiptandpaymentofmoneyandsecurities

Moneyismonetaryfundsusedasameansofpayment.Monetaryfundsthatcanbeusedasmoneyreceiptsandpaymentsincludecash,bankdepositsandothermonetaryfunds,suchasforeigndeposits,bankdraftdeposits,bankcashier'scheckdeposits,currencyfundsintransit,letterofcreditdeposits,guaranteedeposits,andvariousreservefunds.Marketablesecuritiesareticketsthathavecertainpropertyrightsorcontrolrights,suchasstocks,treasurybills,andothercorporatebonds.

Receiptsandpaymentsoffundshappenfrequently,andtheamountincurredisquitelargeinsomeunits.Thefrequencyofreceiptandpaymentofsecuritiesislowerinmostunits,buttheamountincurredisgenerallyrelativelylarge.Thebusinessofreceiptandpaymentoffundsandsecuritiesinvolvesrelativelyvulnerableassets.Mostofthebusinessitselfdirectlycausestheincreaseordecreaseofaunit’smonetaryfunds,whichaffectstheunit’scapitalschedulingability.Therefore,itisusuallyrequiredtoconductstrict,timelyandAccurateaccounting.Theoutstandingprobleminthisaspectinactualworkisthatsomeunitpaymentsarenotincludedintheunit’sunifiedaccounting,buttransferredtothe"smalltreasury";ortheunit’sfundmanagementisoutofcontrol,illegallymisappropriated,orevenembezzlementorevasionoccurs.Andotherissues.Therefore,itisnecessarytostrengthenthemanagementoffundsandsecurities,andestablishandimproveinternalcontrolandothermanagementsystems.

2.Receipt,increase,decreaseanduseofproperty

Propertiesareeconomicresourcesinphysicalformusedbyaunittocarryoutormaintainbusinessmanagementactivities,includingrawmaterials,fuels,packaging,low-valueconsumables,andProducts,self-madesemi-finishedproducts,finishedproducts,commoditiesandothercurrentassetsandmachinery,machinery,equipment,facilities,transportationtools,furnitureandotherfixedassets.

Propertiesandmaterialsconstitutethemainbodyofassetsinmanyunits,andoccupyalargeproportionofthetotalassets.Thebusinessofreceivinganddispatching,increasing,decreasing,andusingofpropertyisarecurringbusinessinaccounting,andtherelevantaccountinginformationisoftenanimportantbasisfortheinternalassessmentofbusinessresults,controlandreductionofcostsandexpenses.Inaddition,financialaccountingalsoplaysanimportantroleinthesafetyandintegrityofvariouspropertiesandmaterials.Forstate-ownedenterprisesandpublicinstitutions,thisisalsoanimportantgatefortheprotectionofstateproperty.However,insomestate-ownedunits,thefunctionofthisgateisgreatlyweakened,andstatepropertyisoftendestroyed,wasted,orembezzledbylawlesselements.Causedthewasteandseriouslossofstate-ownedassets.Asanaccountant,youshouldstrengthentheaccountingandmanagementofpropertyandmaterials.

3.Occurrenceandsettlementofcreditor'srightsanddebts

Creditor'srightsaretherightofaunittocollectpayments,includingvariousreceivablesandadvancepayments.Debtisanobligationthataunitneedstorepaywithitsmonetarycapitalandotherassetsorlaborservices,includingvariousloans,payablesandadvancereceipts,andpayables.

Creditsanddebtsareallthingsthataunitmusthaveinitsownbusinessactivities.Theaccountingfortheoccurrenceandsettlementofclaimsanddebtsinvolvestheeconomicinterestsoftheunitandotherunits,aswellastheunitandotherrelatedparties,andisrelatedtotheunit’sowncapitalturnover.Atthesametime,legallyspeaking,debtalsodeterminestheformationofanenterprise.Creditor'srightsanddebtsareanimportantpartofaccounting.Unitswhosebasicaccountingworkisweakareoftenunabletohandletheaccountingofcreditor'srightsanddebtsinacorrectandtimelymanner,causinglossestotheunit'sreputationandeconomicinterests.Therearealsounitsthatuseaccountsreceivableandpayabletohideortransferfunds,profitsorexpenses,andaresuspectedofviolatinglawsanddisciplines.Accountingpersonnelmuststopandcorrectthisproblem.

4.Increaseordecreaseofcapitalandfunds

Capitalisgenerallytheownershipofthenetassetsoftheenterprisebytheowneroftheenterprise,soitisalsocalledowner’sequity,whichspecificallyincludespaid-incapital,capitalreserve,surplusreserveandundistributedprofit.Fundsmainlyrefertofundsusedbygovernmentagenciesandinstitutionsforcertainspecificpurposes,suchascareerdevelopmentfunds,collectivewelfarefunds,andreservefunds.

Thestakeholdersofcapitalandfundsarerelativelyclear,andtheirusesarebasicallyoriented.Theaccountingfortheincreaseanddecreaseofcapitalandfundsisverypolicy-oriented.Generally,itshouldbebasedonlegallybindingcontracts,agreements,boardresolutions,orrelevantdocumentsofgovernmentdepartments,andavoidblindlyfollowingunitleadersorotherinstructors.Anydispositionopinionsthathavebeenapprovedbylegalproceduresorhavenotgonethroughlegalprocedures.

5.CalculationofIncomeandExpensesandCosts

Incomeistherightofaunittoobtainmoneyorreceivemoneyfromsellingproducts,commodities,providinglabor,services,orprovidingtherighttouseassetsinitsbusinessactivities.Expenditureisunderstoodinanarrowsenseandonlyreferstothevariousexpendituresincurredbyadministrativeinstitutionsandsocialorganizationswhenperformingstatutoryfunctionsorperformingspecificfunctions,aswellastheexpendituresorlossesofenterprisesandcorporateinstitutionsoutsideofnormalbusinessactivities;Inabroadsense,expenditurereferstovariousexpendituresorlossesactuallyincurredbyaunit.Expenseshaveanarrowermeaningthanexpenditures,andusuallyhaveasmallerscopeofuse.Theyonlyrefertovariousexpensesandexpendituresincurredbyenterprisesandcorporatepublicinstitutionsduetoproduction,operationandmanagementactivities.Costsaregenerallylimitedtothedirectexpendituresincurredbyenterprisesandcorporateinstitutionsinproducingproducts,purchasinggoods,andprovidinglabororservices,suchasdirectmaterials,directwages,directexpenses,commoditypurchaseprices,fuel,power,etc.Directcosts.

Income,expenses,expenses,andcostsareallimportantaccountingelements,whichreflectthemeasurementofaunit’smanagementlevelandefficiencyfromdifferentangles,anditisusedtocalculateaunit’soperatingresultsanditsprofitandloss.mostlyaccording.Thecharacteristicsofaccountingfortheseelementsarecontinuous,systematic,comprehensiveandcomprehensive.Inactualwork,themostprominentproblemsarefalsereportingofincome(artificiallydepressedorelevated),falseexpenditures,andrandomallocationofcostsandexpenses.Thishasbecomeoneoftherootcausesthatseriouslyaffectthequalityofaccountinginformation,andaccountantshavetheresponsibilitytostopandcorrectthisphenomenon.

6.Calculationandprocessingoffinancialresults

Financialresultsaremainlythefinancialresultsachievedbyenterprisesandcorporateinstitutionsinacertainperiodoftimebyengaginginbusinessactivities.Thespecificperformanceisprofitorloss.

Calculationandprocessingoffinancialresults,includingprofitcalculation,incometaxcalculationandprofitdistribution(orlosscompensation),etc.Theaccountinginthislinkmainlyinvolvestheinterestsoftheownerandthecountry.Theproblemsinactualworkaremainly"falsegainsandreallosses"and"falselossesandrealgains",whichgenerallyvarydependingonthenatureoftheunit’sownershipsystem,showingatypicalinterest-driventendency,andtheircommonfeatureistoharmthecountryorthepublicinterest.,Isaseriousillegalact.

7.Otheraccountingmatters

Otheraccountingmattersrefertothosethatarenotincludedintheabovesixaccountingitems,andarerequiredtogothroughaccountingproceduresandaccountinginaccordancewithrelevantlawsandregulationsoraccountingsystemsoraccordingtothespecificconditionsoftheunit.Accountingmatters.Whenaunithassuchmatters,itshall,inaccordancewiththeprovisionsofrelevantlaws,regulationsoraccountingsystems,carefullyandstrictlyhandlerelevantaccountingproceduresandconductaccountingcalculations.

Otherrequirements

Forotherrequirementsofaccounting,the"Code"providesprovisionsfromArticle38toArticle46.Theseregulationsaretheextensionandexpansionoftherelevantregulationsinthe"AccountingLaw",andtheyarealsothegeneralizationandreiterationofthecommonrequirementsofthe"AccountingStandardsforBusinessEnterprises"andtheaccountingsystemsofvariousindustries.Atpresent,emphasizingthesebasicnormshasverypracticalsignificance,becausemanyproblemsexistinginaccountingworkdirectlycontradictthesebasicnorms.Atthesametime,thesebasicnormsareanecessaryprerequisiteforagoodaccountingworkorder.Whethertofollowthesebasicnormshasagreatinfluenceonthequalityofaccounting.

1.Accountingbasisandprocessingmethod

Article38ofthe"Specifications"stipulates:"TheaccountingofeachunitshallbebasedontheactualeconomicbusinessandbecarriedoutinaccordancewiththeprescribedaccountingprocessingmethodstoensureaccountingindicatorsThecalibreisconsistent,mutuallycomparable,andtheaccountingtreatmentmethodsareconsistentineachperiodbeforeandafter.”Thisprovisionmainlyreflectsthefollowingrequirements.

(1)Authenticityandobjectivityrequirements.

Accountingshouldbebasedonactualeconomicbusinessandreflecttheauthenticityandobjectivityrequirementsofaccounting.Thespecificrequirementistoobtainreliableevidenceandperformaccurateaccountingbasedontheactualeconomicbusinessthatoccurstoformaccountinginformationthatmeetsthequalitystandards.Accountingbasedonactualeconomicoperationsshouldnotbeaproblem,becauseiftheactualeconomicoperationsarenotusedasthebasis,theentireaccountingwillloseitsmeaning,oritisbettertohavenoaccounting.However,inreallife,basedondifferentpurposesandneeds,problemssuchasforgingoralteringaccountingvouchers,accountingaccountsandaccountingstatements,tamperingwithaccountingdata,andfalseaccountingor"true"accountingoffalseaccountsoccurfromtimetotime.Thishashadagreatimpactonthebasicworkofaccounting,andcauseda"trustcrisis"inaccountinginformationtoacertainextentinthesociety.Whatisgratifyingisthatinordertomaintaintheauthenticityandobjectivityofaccounting,manyaccountantsstillmaintaintheirdueprofessionalethicswhenfacingarelativelydifficultsituation,andmakeunremittingeffortstomaketheoverallqualityofaccountinginformationbasicItisguaranteed.

(2)Legalityrequirements.

Thelegalityrequirementofaccountingreferstotheaccountingoftheeconomicbusinessthatoccursinaccordancewiththeprescribedaccountingtreatmentmethods.Theregulationsonaccountingtreatmentmethodsmainlycomefromtheunifiednationalaccountingsystem,includingthe"AccountingStandardsforBusinessEnterprises","AccountingStandardsforPublicInstitutions"issuedbytheMinistryofFinance,andaccountingsystemsforvariousindustriesorunits.Itisaninternationalpracticetostipulateaccountingtreatmentmethods;reducingthechoiceofenterprisesinaccountingtreatmentmethodsisthetrendinthecurrentworldinstipulatingaccountingtreatmentmethods.Thisisallbasedonthesameconsideration,thatis,toenhancethecomparabilityofaccountingindicators,sothatthehorizontalcomparisonbetweendifferentunitshasastrongeconomicmeaning,andprovideahighervaluebasisforimprovingbusinessmanagementandmakingrationalinvestmentdecisions.Failuretoimplementtheprescribedtreatmentmethodsinaccountingisveryharmful.Forexample,depreciationshouldnotbementioned,interestshouldnotbeaccrued,propertylossesshouldbetreatedornot,salesrevenueshouldberecognizedornotrecognized,costsandexpensesshouldnotbelisted,andtransferredIfitisnottransferredorshouldnotbetransferred,itisreversed.Therefore,theformedaccountinginformationnotonlycannotbeusedformanagementordecision-making,butitwillseriouslymisleadmanagementordecision-making,anddoingsowilldamagetheinterestsofinvestorsandthecountry.

(3)Consistencyrequirements.

Theconsistencyoftheaccountingtreatmentmethodbeforeandaftereachperiodisarequirementfortheconsistencyofaccounting.Whenaunitperformsaccountingforitseconomicoperationsindifferentperiods,itmustmaintainconsistenttreatmentmethods.Thiscanenhancethelongitudinalcomparabilityoftheunit’saccountingindicators.Thiscomparabilityisstilltoimprovemanagementandmanagement.Whatisneededtomakerationalinvestmentdecisions.Consistencyrequiresthattheaccountingtreatmentmethodofaunitmustremainstable,butitdoesnotmeanthattheaccountingtreatmentmethodofthisunitmustremainunchangedfrombeginningtoend.Whentheobjectiveeconomicenvironmentchanges,theneedtoimprovebusinessmanagementorthedevelopmentofaccountingtechnologyisrequired,aunitcanandisallowedtochangeitsaccountingtreatmentmethods.Whensuchachangeoccurs,itisimportantthatitmustbeexplainedinthefinancialreportinaccordancewiththerequirementsofrelevantlawsandregulationsoraccountingsystems,sothatusersofaccountinginformationcanunderstandtheimpactofthischangeinaccountingtreatmentmethods.Thereareproblemsinthisaspectinactualwork.First,thechangesinaccountingtreatmentmethodsarenotcarriedoutinaccordancewithregulations.Undercertaincircumstances,changesinaccountingtreatmentmethodsareallowedtobeused,andaccountingindicatorssuchascosts,expenses,incomeandprofitsareartificiallymanipulated;Itistoconcealthetruefinancialstatusandoperatingconditionsandmisleadusersofaccountinginformationaftertheaccountingtreatmentmethodischanged.Thesebehaviorsarecontrarytotheprofessionalethicsofaccountants.Inseriouscases,theymayviolatethecriminallawandconstitutecriminaloffenses.

2.FiscalYear

Accordingtothe"AccountingLaw",Article39ofthe"Specifications"reiteratesthatthe"accountingyearofeachunitshallstartfromJanuary1toDecember31oftheGregoriancalendar.""

Thefiscalyearistheaccountingperioddefinedintheaccounting,usually12monthsoftheGregoriancalendaryearasafiscalyear.Determiningthefiscalyearistherequirementofthebasicassumptionsofthecontinuousoperationandaccrualsystemofaccounting.Tounderstandthenetincome,operatingincomeandexpenditureresultsorbudgetimplementationofthisunit,itisnecessarytoartificiallyconductfinancialfinalaccountsaccordingtoanequivalentaccountingperiod,soastosummarizetheoperationandmanagementactivitiesoftheaccountingperiod,andallocateanddistributethefinancialresultsobtained.Analyzeandcomparethefinancialresultsofdifferentaccountingperiods.Onlywhenthefiscalyearisdeterminedcanthecurrentperiodandotherperiodsbedistinguished,andtheconceptsofreceivableandpayable,advancereceiptandadvancepayment,andamortizationandadvancecanbeestablished,whichgreatlyimprovestheaccuracyofaccounting.Thefiscalyearcanbedeterminedaccordingtotheunit’sbusinesscycle,theunit’staxyear,orthestate’sfiscalyear,dependingonthenatureoftheunitandlegalrequirements.Asthe"AccountingLaw"andotherrelevantlawshavemadeclearandspecificregulationsonthefiscalyear,eachunitdoesnothavetherighttochoosewhendeterminingthefiscalyear.However,someunitsonlyformallyabidebythelawsandregulationsrelatedtothefiscalyear.Theyeitherrecognizeincomeinadvanceordelay,ordeferorcalculateexpensesinadvance,andartificiallyadjustincomeandcostsacrossyears,whichhasactuallyconstitutedaviolation.Actsstipulatedbylawsconcerningthefiscalyear.

Fortheconvenienceofaccountingandoperationmanagement,itisgenerallynecessarytosettleaccountsandpreparefinancialreportsonaquarterlyandmonthlybasisduringthefiscalyearinordertoprovideaccountinginformationinamoretimelymanner.

3.Standardcurrencyforbookkeeping

TheprovisionsofArticle40ofthe"Specifications"regardingthestandardcurrencyforbookkeepinghavebeenexpandedonthebasisoftheprovisionsoftheAccountingLaw:"AccountingusesRMBasthestandardcurrencyforbookkeeping.Unitswhoseincomeandexpenditurearemainlyinforeigncurrenciescanalsochooseacertainforeigncurrencyasthefunctionalcurrency,butthefinancialstatementspreparedshouldbeconvertedintoRMB.AccountingstatementspreparedbyforeignentitiestotherelevantdomesticauthoritiesshouldbeconvertedintoTherenminbireflects."Currencymeasurementisoneofthebasicassumptionsofaccounting,andtheregulationofthefunctionalcurrencyforbookkeepingisactuallytheregulationofthebasicstandardsofcurrencymeasurement.Itisself-evidentthataunitshouldusethecountry’slegalcurrencyasitsaccountingcurrency.TheRMBisdeterminedasthestandardcurrencyforaccountingofvariousunitsbecauseRMBisChina’slegaltenderandistheonlypaymentmethodallowedinvariouseconomicactivitieswithinChina,soithasthewidestapplicability,andRMBistheunifiedstandard.Therefore,therelatedcostsarealsothelowest.Withthegradualexpansionofopeningtotheoutsideworld,moreandmoreforeign-investedcompaniesareoperatinginChina,andcompaniesinvestingabroadorlistingoverseasarealsoincreasing.China'sforeigntradeandcooperationaredevelopingrapidly.TherevenueandexpenditurebusinessincurrenciesotherthanRMBisinmanyunits.Significantincreaseindailyaccountingcalculationshasledtotheissueofcurrencyofaccounting.Inthisregard,the"AccountingLaw"andthe"Specifications"havemadeadaptiveprovisionstomeettheaccountingneedsofunitswhoserevenueandexpenditurearemainlybasedonforeigncurrencies.

4.AccountingSubjects

Inaccordancewiththeprinciplesstipulatedinthe"AccountingLaw",Article41ofthe"Specifications"enrichesthesettinganduseofaccountingsubjectsforeachunitwithmoreflexibility.Thespecificcontentis:"Inaccordancewiththerequirementsoftheunifiednationalaccountingsystem,eachunitcansetanduseaccountingtitlesaccordingtotheactualsituationwithoutaffectingtheaccountingrequirements,thesummaryofaccountingstatementsandtheunifiedexternalaccountingstatements."Itisanaccountingitemestablishedforfurtherscientificclassificationaccordingtothespecificcompositionofaccountingelements.Thenationalunifiedindustryorunitaccountingsystemgenerallystipulatesthesettingofaccountingsubjectsanddetailedsubjects,titlenames,mainaccountingcontentsandaccountingmethodsofbasicbusiness.Theseregulationsarethebasisforeachunittosetupanduseaccountingsubjects.Atthesametime,duetotheimprovementofaccountingmethodsandthestrengtheningofoperationandmanagement,therefinementofaccountingisnotonlynecessarybutalsopossible,buttherearedifferencesinthestyleandrequirementsofoperationandmanagementbetweenunits.Differencesinaccountsettingandusageneeds.Therefore,eachunitshouldbeallowedtosetupanduseaccountingtitlesonitsownundercertainconditions,sothataccountingcanbettermeetitsneeds.This"certaincondition"is"inaccordancewiththerequirementsoftheunifiednationalaccountingsystem"and"doesnotaffecttherequirementsofaccounting,thesummaryofaccountingstatementsandtheunifiedexternalaccountingstatements."Inactualwork,weneedtobewaryofthetendencytoonlysee"youcansetupanduseaccountingitemsbyyourself"andnotsee"certainconditions".Someunitsarbitrarilyincreaseordecreaseaccountingsubjects,arbitrarilydeterminesubjectnames,arbitrarilychangeaccountingcontent,andfailtocomplywiththeaccountingmethodsofbasicbusinessregulations,andshouldbestoppedandcorrected.Inaddition,insettingupandusingaccountingsubjectsindependently,thebasicunitshouldalsopayattentiontothequalityoftheaccountingpersonneloftheunit.Thatistosay,thesettinganduseofaccountingsubjectsshouldnotonlymeettheinternalneedsoftheunit,butalsomeettheexternalneeds.Theneedforthecompilationofaccountingstatementsandthesummaryofaccountingindicators.

Article41ofthe"Specifications"makesanexceptionforthesettinganduseofaccountingsubjectsofpublicinstitutions:"Thesettinganduseofaccountingsubjectsofpublicinstitutionsshallcomplywiththenationalunifiedaccountingsystemforpublicinstitutions.The"AccountingSystemforPublicInstitutions"issuedbytheMinistryofFinanceonJuly17,1997stipulatesthatpublicinstitutionsshallsetupanduseaccountingsubjectsinaccordancewiththeprovisionsofthesystem,andsubjectsthatarenotneededmaynotbeused.Thisismainlybecausetheaccountingofpublicinstitutionsshouldmeettherequirementsofnationalmacroeconomicmanagement,meettheneedsofbudgetmanagementandrelevantpartiestounderstandthefinancialstatusandincomeandexpenditureofpublicinstitutions,andhelppublicinstitutionstostrengtheninternalmanagement.However,thesystemalsostipulatesthatpublicinstitutionsthatapplythespecialindustryaccountingsystemmaynotimplementthesystem;publicinstitutions’accountingforcapitalconstructioninvestmentshallbeimplementedinaccordancewithrelevantregulations;publicinstitutionsthathavebeenincorporatedintothecorporateaccountingsystemmayalsoAccordingtotherelevantcorporateaccountingsystem.

5.Accountinginformation

Article42ofthe"Specifications"stipulates:"Thecontentandrequirementsofaccountingdocuments,accountingbooks,accountingstatementsandotheraccountingmaterialsmustcomplywiththeprovisionsoftheunifiednationalaccountingsystem,andshallnotbeforgedoraltered.Accountingvouchersandaccountingbooksshallnotbesetupoff-accounts,andfalseaccountingstatementsshallnotbesubmitted."Thisistheenrichmentandreiterationofthe"AccountingLaw",anditisalsooneofthefewmandatoryregulationsinthe"Code".

Theso-calledforgeryofaccountingvouchersandaccountingbooksistoprepareaccountingvouchersandaccountingbooksbasedonthepremiseoffalseeconomicbusiness,aimingtosubstantiatethetruthwithfalseones;alteringaccountingvouchersandaccountingbooksistoalteranddigupTochangethetruecontentofaccountingvouchersandaccountingbooksbyothermeanstodistortthetruth;settingoff-accountaccountsistosetuponeormoresetsofaccountingbooksinadditiontotheaccountingbookssetupinaccordancewithregulations,whichwillchangeaneconomicbusinessMakedifferentreflectionsindifferentaccountingbooks,ordonotconductaneconomicbusinessaccountingthroughtheprescribedaccountingbooks,butreflectitinaseparateaccountingbook,soastoconcealthetruesituation;submitfalseaccountingstatements,yesThroughtheabovemethods,thecontentofaccountingmaterialsisfalseorthedataonthestatementsaredirectlyfalsified,makingtheaccountingstatementsfalseanduntrue,andmisleadingusersofaccountinginformation.Forgingandalteringaccountingvouchersandaccountbooks,settingoff-accountaccounts,andpreparingfalseaccountingstatementsareallseriousviolationsofthelaw.Theydirectlyandindirectlyleadtotheconcealmentofincome,theevasionofnationaltaxes,andthetransferofnationalfunds.Interferewitheconomicdevelopmentandreform,encouragecorruptbehavior,andultimatelydamagetheinterestsofthecountryandthepublic.Therefore,itmustberesolutelystoppedandcorrected.

6.Accountingreportformat

Article43ofthe"Specifications"stipulates:"TheformatofaccountingstatementssubmittedbyvariousunitstotheoutsideworldshallbeuniformlyregulatedbytheMinistryofFinance."ThisisasupplementtotheprovisionsoftheAccountingLaw.

Accountingreportisthefinalproductofaccountingwork.Theaccountingstatementssubmittedbytheunittotheoutsideworldadoptaunifiedformat,whichisconducivetotheconsistencyandcomparabilityoftheaccountingindicatorsofdifferentunits.Itisalsoconducivetothecollectionofaccountingindicatorsbytherelevantstatedepartments.Atthesametime,italsoprovidesameasureofthequalityoftheaccountingworkofaunit.Oneofthestandards.

7.AccountingRecordText

Article46ofthe"Code"reiteratestheprovisionsofthe"AccountingStandardsforBusinessEnterprises"onaccountingrecordtext:"ThetextofaccountingrecordsshouldbeinChinese,andethnicminorityautonomousregionscanuseethnicminoritiesatthesametime.Written.Foreign-investedenterprises,foreignenterprisesandotherforeigneconomicorganizationsinChinacanalsouseacertainforeignlanguageatthesametime."

Textisanindispensablemediuminaccountingandvariousaccountingrecordsformed.Thenumbersleavingthetextdescriptionaredead.Onlywhentheyareorganicallycombinedwiththetextdescriptioncanthenumbersbecomemeaningfulaccountinginformationandcanshowthechangesandresultsofthenatureandquantityofeconomicactivities.The"Specifications"requiretheunifieduseofChineseforaccountingrecords,becauseChineseistheofficiallanguageofChina,andtheuseofChineseforaccountingrecordsisconducivetoensuringtheuniformityofaccountingdata,whichisamajorpremise.Underthispremise,inordertomeetcertainactualneeds,ethnicminorityscriptsoracertainforeignscriptcanalsobeusedsimultaneouslywithChinese,butifonlyacertainminorityscriptoracertainforeignscriptisusedinsteadofChineseatthesametime,That'sirregularbehavior.ThisisdifferentfromtheprovisionsofArticle40ofthe"Specifications"onthefunctionalcurrencyforbookkeeping.

8.Qualityrequirementsofaccountingcalculations

Accountinginformationistheresultofaccountingcalculations,whichisprovidedtoinformationusersbypreparingfinancialaccountingreports.Thesecondchapterofthe"AccountingStandardsforBusinessEnterprises-BasicStandards"stipulatestherequirementsforthequalityofaccountinginformation.Thereareeightitemsintotal,namely,theprincipleofobjectivity,theprincipleofrelevance,theprincipleofclarity,theprincipleofcomparability,theprincipleofsubstanceoverform,theprincipleofimportance,andtheprincipleofprudence.Principlesandtimelinessprinciples.Nowitisdividedintothefollowing:

(1),reliability.Itmeansthatanenterpriseshouldmakeaccountingconfirmation,measurementandreportingonthebasisofactualtransactionsorevents,faithfullyreflectvariousaccountingelementsandotherrelevantinformationthatmeettheconfirmationandmeasurementrequirements,andensurethattheaccountinginformationistrue,reliable,andcomplete.Thisistorequirethatthefinancialstatusandoperatingresultsreflectedintheaccountingdatamustbecompletelytrue,correctandcomprehensive.

(2),relevance.Theprincipleofrelevancemeansthattheaccountinginformationprovidedbyanenterpriseshouldberelevanttotheeconomicdecision-makingneedsofusersoffinancialaccountingreports,whichhelpsusersoffinancialaccountingreportstoevaluateorpredictthepast,present,orfutureconditionsoftheenterprise.Withthetransformationofcorporatemanagementmechanisms,corporateownershipandmanagementrightsareseparated,ownershipbelongstoinvestors,andmanagementrightsbelongtotheenterpriseitself.

(3),understandability.Theprincipleofclaritymeansthattheaccountinginformationprovidedbyanenterpriseshouldbeclearandclear,sothatusersoffinancialaccountingreportscanunderstandanduseit.Thisprincipleisveryimportanttousersofaccountinginformation.Therefore,accountinginformationshouldbeaseasytounderstand,simpleandclearaspossible.Importanteconomicoperationsshouldbeexplainedinstandardizedtextwhenreportingtofacilitatebusinessdecision-making.

(4)Comparability.Theprincipleofcomparabilitymeansthatthesameorsimilartransactionsoreventsthatoccurinthesameenterpriseindifferentperiodsshouldadoptconsistentaccountingpoliciesandshouldnotbechangedatwill.Ifitisreallynecessarytochange,itshouldbeexplainedinthenotes.Forthesameorsimilartransactionsoreventsthatoccurindifferententerprises,theprescribedaccountingpoliciesshallbeadoptedtoensurethattheaccountinginformationisconsistentandcomparable.Thisprinciplehastworequirementsforthequalityofaccountinginformation.Ontheonehand,thecalculationandprocessingmethodsofaccountingdataofthesameenterpriseindifferentaccountingperiodsshouldbeconsistent.Thisisbecausetheremaybeseveraldifferentcalculationandprocessingmethodsforthesametypeofaccountingitems.Ifyouusedifferentmethodstocalculateandprocessthesametypeofaccountingitems,youmaygetdifferentresults,whichwillaffectthefinancialstatusandoperatingresultsofthecompany.Withdifferenteffects,accountingindicatorswilllackcomparabilitybeforeandafterdifferentaccountingperiods.Thisrequiresthecompanytochooseamethodbasedonitsownspecificconditions,anditshouldalwaysbeusedconsistently,anditshouldnotbechangedfromtimetotime.Butthisisonlyrequiredtoberelativelystablewithinacertainperiodoftime.Itisnotabsolutelyimpossibletochange.Ifitmustbechanged,itshouldbeexplainedinthefinancialstatementtofacilitatetheanalysisandcomparisonofinformationusers.Ontheotherhand,differententerprisesshouldadoptprescribedaccountingpoliciesforthesameorsimilartransactionsormatterstoensurethattheaccountinginformationisconsistentandcomparable.Inthisway,itcanbeensuredthattheaccountingindicatorsprovidedbydifferentownerships,betweendifferentdepartments,andbetweendifferentindustriesareconsistentandcomparabletoeachother.Thiscanmeettheneedsofthecountryforcomprehensivebalanceandstrengtheningofbusinessmanagement.

(5),substanceismoreimportantthanform.Theprincipleofsubstanceoverformmeansthatanenterpriseshouldperformaccountingconfirmation,measurementandreportinginaccordancewiththeeconomicsubstanceofthetransactionorevent,andshouldnotbebasedsolelyonthelegalformofthetransactionorevent.Forexample,afixedassetleasedintheformofafinanciallease,althoughthecompanydoesnothaveitsownershipinlegalform,theleaseperiodspecifiedintheleasecontractislong,andattheendoftheleaseperiod,thecompanyhastheprioritytopurchasetheasset.Option,duringtheleaseperiod,theleasedcompanyhastherighttocontroltheassetsandbenefitfromit.Therefore,fromtheperspectiveofeconomicsubstance,thecompanycancontrolthefutureeconomicbenefitsitcreates.Therefore,thefixedassetsleasedintheformoffinancialleaseswillberegardedasfixedassetsinaccounting.Itisanassetoftheenterprise.

(6),importance.Theprincipleofmaterialitymeansthattheaccountinginformationprovidedbyanenterpriseshouldreflectallimportanttransactionsormattersrelatedtothefinancialstatus,operatingresults,andcashflowoftheenterprise.Thisprinciplerequirescompaniestoaccountforthoseimportanteconomicactivitiesseparately,reportthemseparately,striveforaccuracy,andmakekeyexplanationsintheirfinancialreports.Forminoraccountingmatters,theprocessingcanbesimplifiedappropriately.Importanceisarelativeconcept,andithasacertainrelationshipwiththesizeandnatureofthecompany.Becausestrictaccountingproceduresanddetailedaccountingproceduresarelaboriousandcostly,theaccountingdataisdistinguishedbetweenimportantandunimportant,andexceptionsareallowedforunimportantmatterstobehandledflexiblyinordertocomplywith"benefits>costs".Principles,toavoidthelossofaccountingtreatment,andtoimprovetheeconomiceffectofaccounting.

(7),prudence.Theprincipleofprudence,alsoknownastheprincipleofconservatism,meansthatenterprisesshouldexerciseduecareintheaccountingconfirmation,measurementandreportingoftransactionsorevents,andshouldnotoverestimateassetsorearnings,orunderestimateliabilitiesorexpenses.Inotherwords,accountingmustbetruthfulabouttheestimatedgainsandlosses,andmustnotberushed.Itmustbeclearthattheadoptionoftheprincipleofprudencerequirescompaniestoberesponsibletothepeopleandcarefullyhandlepossiblegainsandlossestoensurethatthedataprovidedbyaccountingistrueandreliable.Thename"cautious"isneverallowed.Falsification,under-countingofgains,over-countingoflosses,andtaxevasion,usingtheprincipleofprudenceasameansofconcealingprofitsandadjustingthelevelofprofitability.

(8),Timeliness.Theprincipleoftimelinessmeansthatanenterpriseshallmakeaccountingconfirmation,measurementandreportingoftransactionsoreventsthathaveoccurredinatimelymanner,andshallnotbeadvancedorpostponed.Itisveryimportanttodealwithdailyaccountingmattersinatimelymanner.Onlybyconfirming,measuringandreportinginatimelymannercanvariousaccountingindicatorsbeprovidedinatimelymanner,whichisconducivetotherapiddetectionofproblemsinoperationandmanagementbyrelevantdepartmentsandtimelymeasurestoimproveoperationandmanagement..Otherwise,timehaspassed,thereisnowaytoremedyit,andaccountingwillloseitsdueroleinoperationandmanagement.

Features

RelatedexpertsofFiberhomeHeadhuntingCompanybelievethatthecharacteristicsofaccountingrefertothedifferencesbetweenaccountingandothereconomicaccounting.Becauseaccountingisthebasiclinkofaccounting,thecharacteristicsofaccountingaremainlyreflectedinaccounting,ithasthreebasiccharacteristics:(1)Currencyisthemainmeasurementscale,anditiscomprehensive

Accountingneedstouseavarietyofmeasurementscalestoreflectandsuperviseaccountingcontent,includingphysicalscales(suchaskilograms,tons,pieces,etc.),laborscales(suchasworkinghours,workingdays,etc.),andcurrencyscales.Mainlyoncurrencyscale.Thephysicalscaleandlaborscalecanspecificallyreflecttheincreaseordecreaseofvariouspropertiesandmaterialsandthelaborconsumptionintheproductionprocess.Theyarenecessaryforaccountingandeconomicmanagement,butneitherofthesetwoscalescancomprehensivelyreflectthecontentofaccounting.Itisamajorfeatureofaccounting.Accountingusescurrencyasacomprehensivemeasurementscale.Throughaccountingrecords,itispossibletocomprehensivelyandsystematicallyreflectandsupervisethefinancialincomeandexpenditureofpropertyandmaterialsofenterprises,administrativeunitsandinstitutions,laborconsumptionandresultsintheproductionprocess,andcalculatethefinalfinancialResults.Therefore,intheprocessofaccounting,thephysicalscaleandlaborscalehavebeenusedtorecord,anditmustbereflectedcomprehensivelyonthemonetaryscale.

(2)Accountingiscomplete,continuousandsystematic

Theaccountingofeconomicbusinessmustbecomplete,continuousandsystematic.Theso-calledcompletenessmeansthatalleconomicoperationsthatarepartofaccountingmustberecordedinaccounting,andanyoneofthemisnotallowedtobeomitted.Theso-calledcontinuousreferstothesequentialanduninterruptedrecordingandaccountingofvariouseconomictransactionsaccordingtothetimetheyoccur.Theso-calledsystemreferstotheclassificationandcomprehensiveaccountingofvariouseconomicoperations,andtheprocessingandsortingofaccountingdatatoobtainsystematicaccountinginformation.

(3)Accountingshouldbebasedonvouchersandstrictlyfollowaccountingnorms

Accountingrecordsandaccountinginformationemphasizeauthenticityandreliability.Alleconomicoperationsthatrequireenterprises,administrativeunits,andpublicinstitutionsmustobtainorfillinlegalvouchers,andperformaccountingonthebasisofthevouchers.Accountingstandardsmustbestrictlyfollowedatallstagesofaccounting,includingaccountingstandardsandaccountingsystems,toensuretheauthenticity,reliabilityandconsistencyofaccountingrecordsandaccountinginformation.

Types

1.Typesofaccountingforms

Duetothedifferencesinthesizeofeachunit,businessandmanagementrequirements,Whenchoosingtheaccountingmethod,itisnaturalnottoinsistonuniformity.Accordingtothelong-termpracticeofaccountingwork,andaccordingtothedifferentbasisandmethodsofregisteringtheaccountinggeneralledger,thefollowingfiveaccountingformshavebeenformed:

(1)Accountingformsofbookkeepingvouchers;

(1)p>

(2)Accountsummarytableaccountingform;

(3)Summarybookkeepingvoucheraccountingform;

(4)Multi-columnjournalaccountingform;

(5)Theaccountingformofthejournalgeneralledger.

Classificationbasis

Classificationbasisofaccountingforms

Theabovefiveaccountingformshavemanysimilarities,buttherearealsodifferences..Themaindifference,thatis,theirrespectivecharacteristicsaremainlymanifestedinthebasisandmethodofregisteringthegeneralledger.Fromtheoverallanalysis,themethodsofregisteringthegeneralledgercanbedividedintotwocategories,namelydirectregistrationandcollectiveregistration.Directregistrationisamethodofdirectlyregisteringthegeneralledgerbasedontheaccountingvouchers.Theaccountingvouchersandthejournalgeneralledgeraccountingfallintothiscategory;theotherrequiresregularaccountingvouchersinacertainway.Summarize,registerthegeneralledgerbasedonthesummarizeddata,whichsimplifiestheworkofregisteringthegeneralledgertoacertainextent.Theaccountsummarysheetaccountingformandthesummaryaccountingvoucheraccountingformbelongtothiscategory.

Themulti-columnjournalaccountingformcombinesthecharacteristicsofthesetwomethods.Forcashandbankdeposits,thegeneralledgerisregisteredintheformofsummaryregistration,whileforthosewithsmallbusinessvolume.Thetransferbusinessisdirectlyregisteredinthegeneralledgerbasedontheaccountingvouchers.Onlywhenthetransferbusinessisalsolarge,thegeneralledgerisregisteredinasummarymanner..

Basicpremise

Thebasicpremiseofaccounting,alsoknownasaccountinghypothesis,ispeople’sunderstandingofeconomicthingsandaccountingphenomenathathavenotbeenaccuratelyunderstoodorcannotbepositivelydemonstrated.Reasonableinferencesmadebynormalconditionsortrends.Thebasicpremiseofaccountingincludesfouraspectsofaccountingsubject,continuingoperation,accountinginstallmentandcurrencymeasurement.

Accountingentity

Accountingentityreferstotheobjectsthataccountantsserve.AccordingtoArticle4ofthe"AccountingStandardsforBusinessEnterprises","Accountingshouldtargetthevariouseconomicoperationsoftheenterprise,recordandreflectthevariousproductionandoperationactivitiesoftheenterpriseitself."ThebasicpremiseoftheaccountingentitycontainsthefollowingfourThemeaningoftheaspect:

(1)Therecanbeonlyonespecificunit(enterprise)forwhichtheaccountantserves,butnottwoormore.Thisisbecausetheaccountingmeasurementofassets,liabilities,andowner'sequityisbasedonthepowersandobligationsofthisspecificenterprise,andincomeandexpensesarealsobasedonthespecificenterprise,andarerecognizedaccordingtotheprincipleofrealizationandmatching.Undertheconditionsofamarketeconomy,ifanenterprise,asacommodityproducerandoperator,needstoaccountindependentlyandberesponsibleforitsownprofitsandlosses,itmustseparatetheoperatingactivitiesofaparticularenterprisefromtheoperatingactivitiesofotherenterprises,andindependentlyandcompletelyreflectaparticularenterprise.Inordertoclarifytheresponsibilitiesofoperationandmanagement,andmakecorrectdecisionsbasedontheinformationprovidedbyaccountingcalculations.

(2)Theobjectsofaccountingservicesareeconomicallyindependent,sonotonlytheeconomicrelationshipbetweendifferententerprisesmustbeclearlydivided,butalsothebusinessactivitiesoftheenterpriseandtheownershipoftheenterpriseTheeconomicactivitiesoftheindividualandtheindividualemployeesoftheenterprisearedistinguished.Forexample,whenthebusinessownerandtheoperatorarethesameperson,becausetheobjectofaccountingservicesisthebusinessasaneconomicentity,itisnecessarytoseparatetheowner’spersonalconsumptionfromthebusiness’sexpenditure,andthusdeterminethatthebusinessaccountingEnterthecontentsoftheaccountandclearthetransactionsbetweentheenterpriseandthebusinessowner(owner)inatimelymanner.Otherwise,theexpenditureandprofitoftheenterprisecannotbemeasured,andthecomparisonandanalysisofeconomicbenefitscannotbecarriedout.Foranotherexample,anenterprisewithdrawsanemployeewelfarefeeaccordingtotheregulations,whichindicatesthattheenterprisehasincreasedadebt,andwhentheenterpriseincursemployeewelfareexpenditure,itisnolongerregardedasanexpenseoftheenterprise,butshouldberegardedasthepaymentoftheenterprisedebt.

(3)Thereisadifferencebetweenanenterpriseasanaccountingentityandanenterpriseasalegalperson.Alegalpersonreferstoalegalentitythatisregisteredinagovernmentdepartment,hasindependentproperty,andcanbearcivilliabilities.Itemphasizestheeconomicandlegalrelationshipbetweentheenterpriseandallaspects.Theaccountingentityisestablishedinaccordancewiththerequirementsofcorrectlyhandlingtherelationshipbetweentheownerandtheenterpriseandthecorrecthandlingoftheinternalrelationshipoftheenterprise.Althoughalloperatinglegalpersonsareaccountingentities,someaccountingentitiesmaynotnecessarilybelegalpersons.Forexample,someenterprisegroupshavemanysubsidiaries,andthesesubsidiariesarealsolegalpersons.However,duetotheneedsofoperationandmanagement,itisacomprehensivemeasurementandreflectionofthegroup.Forthecompany’soperatingactivitiesandfinancialresults,allsubsidiariesandtheparentcompanymustbeusedasanaccountingentitytoprepareconsolidatedaccountingstatementsinordertofullyreflectandevaluatethefinancialstatusandoperatingresultsoftheentiregroupcompany.

(4)Theenterpriseforwhichaccountingservesisaneconomicentityandexistsasawhole.InChineseenterprises,internalbankshavebeenwidelypromoted,andinternaleconomicaccountingofin-plantworkshopsorteamshasbeenadopted.Thisisofgreatsignificanceforclarifyingtherightsandresponsibilitiesofinternalunitsoftheenterpriseandmobilizingtheenthusiasmofthemajorityofemployeesforproduction.However,theworkshoporteaminthefactorycanonlybetheaccountingunitwithintheenterprise,nottheaccountingentityinthefullsense.Thisisbecausetherearecomplexeconomictiesbetweentheinternalunitsoftheenterprise.Theycannotberegardedasindependentandoveralleconomicentities,cannotcompletelydividetheirrespectiveeconomicoperations,andcannotperformaccountinginthetruesense.Therefore,theinternalaccountingunitofanenterprisedoesnotfullymeettherequirementsofanaccountingentity.

Itshouldbepointedoutthattheobjectofaccountingservicesmaynotbeanenterpriseatall.Forexample,itmaybeacertainorganization,institutionorgroup,orevenacertainregionortheentirenationaleconomy.Inthisway,the"AccountingStandardsforBusinessEnterprises"maynotbeapplicable,andspecialprinciplesandmethodsneedtobeadoptedtoconstitutenon-profitunitaccountingandsocialaccounting.

Accountingperiod

Accountingperiodreferstothedivisionofaccountingperiodsinenterpriseaccounting,thatis,thecontinuousprocessofbusinessactivitiesisartificiallydividedintoend-to-end,equalintervalsDuringtheaccountingperiod,thecompany’soperatingactivitiesarereflectedandcontrolledininstallments,theincome,expensesandprofitsofeachaccountingperiodaredetermined,theassets,liabilitiesandowner’sequityofeachaccountingperiodaredetermined,accountsettlementsandaccountingstatementsareprepared.Forthisreason,Article7ofthe"AccountingStandardsforBusinessEnterprises"stipulatesthat"Accountingshoulddividetheaccountingperiodtosettleaccountsandprepareaccountingstatements."Theprerequisiteforaccountinginstallmentsismainlymanifestedinthefollowingaspects:

(1)Accountinginstallmentsarethebasisforcorrectcalculationofperiodprofitsandlosses.Therealizationofincomeisforaspecificaccountingperiod,andtherecognitionofexpensesisalsomatchedwiththeincomeofaspecificperiod.Ifthebusinessactivityreportedbytheaccountantisonlyaone-offactivity,thenallincomeandexpenseswillendinoneoperatingperiod.Iftheaccountingmeasurementandreportisacertainsegmentofthecontinuousbusinessactivitiesofanenterprise,itcannotbeexpectedtoincludealltheexpensesandbenefitsincurredinanaccountingperiodintothecurrentproductatonce,butmustbebasedontheaccountingperiodandineachproductioncycle.Makeanassignment.

(2)Theprerequisiteofaccountinginstallmentsstrengthensthepredictivenatureofaccountinginformation.Sincethebusinessactivitiesoftheenterprisearedividedintoequalperiods,certainincomeandexpensesneedtobeallocatedbetweenthecurrentperiodandthefutureperiods,suchasfixedassetdepreciation,intangibleassetamortization,costofsalescarry-forwardandrelatedincomeForecastinganddeferring,etc.,requireaccountantstousepastexperienceandusejudgmentmethodstodealwith,whichstrengthensthepredictivenatureofaccountinginformation.

(3)Theprerequisiteofaccountinginstallmentsstilllargelyrestrictsthequalityrequirementsofaccountinginformation.Forexample,comparabilityandconsistencyareimportantcharacteristicsofaccountinginformation.Notonlycantheaccountinginformationofdifferentcompaniesbecompared,butitalsorequiresthattheaccountingtreatmentmethods,procedures,oraccountingpoliciesandprinciplesofdifferentperiodsshouldbeestablishedonaconsistentorcomparablebasistoensurethateachTheusefulnessofdataonfinancialstatusandoperatingresultsfortheperiodoftime.Forthesameaccountingitems,iftheaccountingtreatmentmethodischangedindifferentaccountingperiods,itwillresultindifferentresultsofenterpriseassetvaluationandincomedetermination,anditisimpossibletocomparetheactualoperatingconditionsofeachperiod.Therefore,thepremiseofaccountinginstallmentisstillthebasisforestablishingtheprincipleofcomparabilityandconsistency.Inaddition,inaspecificperiod,companiesoftenhavemanyeconomictransactionsthathavenotyetbeenformedorfinallyachievedtheirresults,andestimationmethodsneedtobeadoptedtoacertainextent.Accountingestimateswillinevitablyappearhighorlow.Therefore,whenitcomestothechoiceofaccountingmeasurementmethods,itisnecessarytoproperlyconsidertheprincipleof"prudence"tooffsetoratleastreducethepossiblelossesinthefutureperiodtoensurethattheaccountingfirmTheinformationprovidedistrue.

(4)Accordingtothepremiseofaccountinginstallment,theaccountantmustdividethevaluemovementprocessasitsobjecttoacertainextent,anddividethevaluemovementintothreecategories,oneisthecompletedhistoricalvaluemovement;theotherisTheongoingvaluemovement;thethirdisthevaluemovementthatwilltakeplace.Fromtheperspectiveofcontinuousoperation,thevaluemovementofanenterprisecanbetransformedaccordingtothethreevaluemovementsofthefuture,thepresent,andthehistory,thusformingpre-predictivedecision-makingaccounting,in-eventresponsibilitycontrolaccountingandpost-eventexternalreportingaccounting.Foraspecificaccountingperiod,wemustfirstplanthefuturevaluemovementthroughforecasting,decision-making,budgetingandothermethods;thencomparetheactualamountwiththebudgetedamount,revealthedifference,adjustthebudgetandcorrectthebehaviorintime,Implementprocesscontrol;afteracertainaccountingperiodends,itisstillnecessarytomeasureanddeterminetheoperatingresultsoftheaccountingperiodandthefinancialstatusattheendoftheaccountingperiodasthebasisforfinancialdistributionandfinancialanalysis.

Accountinginstallmentsareusuallyoneyear,whichcanbeacalendaryear,afiscalyear,orevenabusinessyear(usuallythetimewiththelowestbusinessvolumeisusedasthehandoverpointbetweenthetwoaccountingperiods).Withtheincreasingdependenceofeconomicmanagementonaccountinginformation,theaccountingperiodunithasatendencytobefurtherdividedintosmallerones,suchasquarters,months,tendays,weeks,andsoon.Inordertoensurethecomparabilityofvariousperiods,someforeigncompaniesalsotrytoimplementunitssuchasaccountingquarters(13weeksperquarter)oraccountingmonthstomakeupfortheinequalitybetweencalendarmonthsandquarters.

Article6ofthe"AccountingStandardsforBusinessEnterprises"stipulatesthatChina"accountingperiodisdividedintoyear,quarterandmonth.Thebeginningandendingdatesoftheyear,quarterandmonthadopttheGregoriancalendar."Inotherwords,eachyearfromJanuary1toDecember31isafiscalyear,thefirstdayofthefirstmonthofeachquartertothelastdayofthequarterisafiscalquarter,andthefirstdaytothelastdayofeachmonthisAnaccountingmonth.Enterprisesshallsettleaccountsbyannual,quarterlyandmonthlyinstallmentsandprepareaccountingstatements.

Currencymeasurement

Currencymeasurementalsoincludesconstantcurrencyvalue.Inordertocontinuously,systematically,comprehensivelyandcomprehensivelyreflecttheeconomicbusinessofanenterprise,itisobviouslyimpossibletousevariousphysicalmeasurementunitsformeasurement,butonlycurrency(strictlyspeaking,itshouldbeconceptualcurrency)asaunifiedmeasurementscale.Thisisbecause:

(1)Currencyisthecommonyardsticktomeasurethevalueofallothervaluables;

(2)Currencyisthemediumofexchange;

(3)Currencyisthestoreofvalue;

(4)Currencyisthesettlementmethodofclaimsanddebts;

(5)Onlycurrencycanenterthedouble-entrybookkeepingsystem.

Afterdeterminingthecurrencymeasurement,thecorporateaccountingcurrencyshouldalsobeclarified.Forthisreason,Article7ofthe"AccountingStandardsforBusinessEnterprises"stipulates:"AccountingusesRMBasthestandardcurrencyforbookkeeping.Enterpriseswhosebusinessincomeandexpenditurearemainlyforeigncurrencycanalsochooseacertainforeigncurrencyasthestandardcurrencyforbookkeeping,buttheaccountingReportsshouldbeconvertedintoRMB.Foreigncompaniesshouldconverttheiraccountingstatementstotherelevantdomesticauthorities,andtheyshouldbeconvertedintoRMB.”Accordingtothisregulation,domesticcompaniesshouldgenerallyuseRMBasthestandardcurrencyforaccounting;foreignexchangeshouldbeusedindailybusinessactivities.Inordertofacilitatethecompany'sexternalbusinessdevelopment,toadapttothecharacteristicsoftheenterpriseandsimplifytheaccountingprocedures,theincomeandexpenditure-basedenterprisescanalsouseacertainforeigncurrencyastheaccountingstandardcurrency.Foroverseascompanies,sincetheirdailyoperationsarenaturallybasedinforeigncurrencies,theiraccountingisbasedonacertainforeigncurrencyasthestandardcurrencyforbookkeeping.However,whentheseoverseascompaniesprepareaccountingstatementstotherelevantdomesticauthorities,theyshouldbeconvertedintoRMB.

Itshouldbepointedoutthatwithcurrencyasaunifiedunitofmeasurement,thereisanadditionalprerequisite,thatis,itisassumedthatthevalueofcurrencyitselfremainsunchanged.Inotherwords,fluctuationsinthepurchasingpowerofcurrenciesarenotconsidered.Accordingtotheaccountingpracticesofvariouscountriesintheworld,whenthevalueofthecurrencyitselffluctuateslittleorcanbeoffsetbythefluctuations,thesefluctuationscanbeignoredinaccounting,andthecurrencyvalueisstillconsideredtobestable,butintheeventofdeterioratinginflation,(suchasTheannualinflationratereaches26%,orthethree-yearinflationratereaches100%),itisnecessarytoadoptspecialaccountingstandards(suchasinflationaccountingstandards)todealwithit.

Formalmeaning

Specifically,theformofaccountingreferstothestepsandmethodsofprocessingtheoriginalinformationofeconomicbusinesstogenerateaccountinginformation,namely,accountingvouchers,accountingbooks,andaccountingstatementsThemethodofcombiningwithbookkeepingmethodsandbookkeepingproceduresisalsocalledtheformofaccountingorganization.Tobetterreflectandsupervisetheeconomicactivitiesofenterprisesandprovidesystematicaccountingdataforeconomicmanagement,specialaccountingmethodsmustbeusedinconjunctionwitheachother,andcertainorganizationalproceduresmustbeadoptedtostipulatethetypesandtypesofaccountingvouchers,accountbooksandaccountingstatements.Format;stipulatestherelationshipbetweenvariousaccountingdocuments,accountingbooksandaccountingstatements,fillingmethodsandregistrationprocedures,anditscoreistospecifythemethodofregisteringthegeneralledger,whichisanimportantcontentofthedesignoftheaccountingsystemItisalsothemainbasisfordistinguishingvariousformsofaccounting.Reasonableorganizationofaccountingformsisanimportantconditionforaccountingwork.Itisofgreatsignificanceforensuringthequalityofaccountingwork,improvingaccountingefficiency,preparingaccountingstatementsinacorrectandtimelymanner,andmeetingtheneedsofrelevantaccountinginformationusers;atthesametime,itisreasonable.Thenewformofaccountingcanorganizetheaccountingworkofanenterpriseintoaseparateandcollaborativeorganicwhole,andeffectivelyorganizetheworkofeachaccountingpost,whichreducestheworkloadofaccountants,savesmanpowerandmaterialresources,andEffectivelyimproveworkefficiencyandquality.

Accountingprinciples

1.Theprincipleofobjectivity

Theprincipleofobjectivitymeansthataccountingmustbebasedontheactualeconomicbusinessandthelegalevidencethatreflectstheoccurrenceofeconomicbusiness.Asabasis,themarket’sentryintothemarketreflectsthefinancialstatusandoperatingresults,sothatthecontentistrue,thefiguresareaccurate,andtheinformationisreliable.Theprincipleofobjectivityisthebasicqualityrequirementforaccountingandaccountinginformation.

2.Theprincipleofrelevance

Theprincipleofrelevancemeansthataccountingshouldbeabletomeettheneedsofallrelevantpartiesforaccountinginformation.Thedatageneratedbyaccountingshouldmeettheneedsofthecountry'smacroeconomicmanagement,meettheneedsofrelevantpartiestounderstandthefinancialstatusandoperatingresultsoftheenterprise,andmeettheneedsoftheenterprisetostrengtheninternaloperationandmanagement.

3.Theprincipleofcomparability

Theprincipleofcomparabilitymeansthataccountingmustbecarriedoutinaccordancewiththeprescribedprocessingmethod,andtheaccountinginformationmustbeconsistentandcomparable.Ensuringthecomparabilityofaccountinginformationisconducivetoeconomicmanagementandmacroeconomicdecision-making.

4.Theprincipleofconsistency

Theprincipleofconsistencymeansthattheaccountingtreatmentmethodsandproceduresadoptedbytheenterprisemustbeconsistentineachperiodbeforeandafter.Theenterpriseshallnotchangetheaccountingtreatmentmethodandprogram.Theprincipleofconsistencyisproducedonthebasisoftheprincipleofcomparabilityandisaguaranteefortherealizationoftheprincipleofcomparability.

5.Theprincipleoftimeliness

Theprincipleoftimelinessmeansthattheaccountingworkmustbepracticalandeffective,andtheaccountingtreatmentshouldbecarriedoutinatimelymanner,whileaccountinginformationcanbeusedinatimelymanner.

6.Theprincipleofclarity

Theprincipleofclaritymeansthataccountingrecordsandaccountingstatementsshouldbeclear,concise,easytounderstandanduse.

7.Theprincipleofaccrualbasis

Theprincipleofaccrualbasismeansthattherecognitionofrevenueandexpensesshouldbebasedonactualoccurrenceandimpactastheconfirmationandmeasurementstandard.Allincomesandexpensesthathavebeenrealizedinthecurrentperiodandexpensesthathavebeenincurredorshouldbeborne,regardlessofwhetherthepaymentisreceivedorpaid,shouldbetreatedasincomeandexpensesofthecurrentperiod;allincomeandexpensesthatarenotpartofthecurrentperiod,evenifthepaymenthasbeenreceivedandpaidinthecurrentperiod,Norshoulditbeusedascurrentincomeandexpenses.Theaccountingofincomeandexpensesbasedontheaccrualsystemcanaccuratelyreflectthetruefinancialstatusandoperatingresultsoftheenterpriseinaspecificaccountingperiod.

8.Theprincipleofmatchingratio

Theprincipleofmatchingratiomeansthatoperatingincomeanditscorrespondingcostsandexpensesshouldbecoordinatedwitheachother.Itrequiresthatthevariousincomesandrelatedcostsandexpensesinanaccountingperiodshouldberecognizedandmeasuredinthesameaccountingperiod.Itrequiresenterprisestopayforthecurrentincomebasedonthecausalrelationshipbetweenincomeandexpensesinacertainperiod.Confirmandmeasurewithexpenses.Adheringtotheprincipleofmatchingisconducivetothecorrectcalculationandassessmentofoperatingresults.

9.Thehistoricalcostprinciple

Thehistoricalcostprinciplemeansthatthevariouspropertyandmaterialsofanenterpriseshouldbeaccountedforattheactualcostatthetimeofacquisition.Theso-calledhistoricalcostisthecashandotherequivalentsactuallypaidwhenacquiringormanufacturingacertainpropertyormaterial.Thehistoricalcostprinciplerequiresthatthemeasurementofcorporateassets,liabilities,andequityshouldbebasedontheactualtransactionpriceorcostofeconomicbusiness,withoutconsideringtheimpactofmarketpricechanges.Whenpriceschange,unlessotherwisespecified,thebookvaluewillnotbeadjusted.

10.Theprincipleofdividingincomeexpenditureandcapitalexpenditure

Basedonthepremiseofaccountingperiod,accountingshouldfollowtheprincipleofdividingincomeexpenditureandcapitalexpenditure.Theprincipleofdividingincomeexpenditureandcapitalexpendituremeansthataccountingshouldstrictlydistinguishtheboundarybetweenincomeexpenditureandcapitalexpenditureinordertocorrectlycalculatethecurrentprofitandlossoftheenterprise.Allexpenditureswhosebenefitsarerelatedtothecurrentfiscalyearshallberegardedasincomeexpenditures,andallexpenditureswhosebenefitsarerelatedtoseveralfiscalyearsshallberegardedascapitalexpenditures.

11.Theprincipleofprudence

Theprincipleofprudence,alsoknownastheprincipleofconservatism,referstoaccountantswhohavedifferenthandlingmethodsandproceduresforcertainbrokeragebusinessoraccountingmatterstochoosefromAtthesametime,thepossiblerisksshallbeconsidered,andthepossiblelossesandexpensesshallbecalculatedreasonably.Theprincipleofprudenceisaimedattheuncertainfactorsineconomicactivities,requiringacautiousattitudeinaccountingtreatment,fullyestimatingrisksandlosses,andminimizingordisregardingpossiblegains.Itisauserordecisionmakerofaccountinginformation.Increasevigilancetocopewithchangesintheexternaleconomicenvironment,trytoavoidrisksandlimitthemtoaminimum.Thepracticeofmakingprovisionforbaddebtsandmakingdepreciationreflectstheprincipleofprudence.

12.Theprincipleofmateriality

Theprincipleofmaterialityreferstotheimportanceofeconomicbusinessoraccountingmattersintheaccountingprocess,andtheuseofdifferentaccountingtreatmentmethodsandprocedures.Followtheprincipleofmateriality,requiringthatimportantaccountingmatters(suchasthoserelatedtobusinessdecision-makingorimportanttousersofaccountinginformation)shouldbeaccountedforseparately,andresponsesshouldbeshared,strivetobeaccurate,andmakekeyexplanationsintheaccountingreport;andForthosesecondaryaccountingmatters,withoutaffectingtheauthenticityoftheaccountinginformation,accountingcanbeappropriatelysimplifiedandcombinedandreflected.

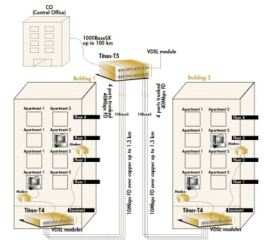

Centralizedaccountingofaccounting

(1)Mainmethodsofcentralizedaccountingofaccounting

1.Canceltheunitaccountandsetupanaccountingaccount.TheAccountingCenteropensaccountsforeachunitinthebank,andimplements"unifiedmanagementandaccount-by-accountaccounting".TheFinanceBureauandtheCountyPeople'sBankareresponsiblefortheunifiedhandlingofaccountcancellationanddepositbalancetransferprocedures.

2.Centralizedmanagementofaccountingfiles.Afterbeingincludedinthecentralizedaccounting,theaccountingfilesofeachunitwillbekept,cataloged,filed,andarchivedinaunifiedmannerbytheaccountingcenter.

3.Canceltheaccountingorganizationoftheunitandimplementtheaccountantsystem.Theunitcancelstheaccountingorganizationandaccountingpersonnel,andsetsupafull-timeaccountclerkwhoisresponsibleforapplyingtotheaccountingcenterforpaymentandhandlingthespecificbusinessoftheunit'sfinancialincomeandexpenditure.Accordingtothebusinessvolumeoftheunit,theaccountingcenterseparatelyapprovedandissuedreservefundsfortheaccountclerkstopaytheunit'ssporadicexpenses.

4.Handlethedirectpaymentofwages.Onthebasisofcleaningupthefinancialsupportpersonnelandwagestandards,theaccountingcenterimplementsunifiedwagepayment.Theaccountingcenterestablishesasalaryaccountinthebankforeachcadreandemployee,andtransferstheauditedsalarytothesalarycardonamonthlybasis.

5.Unifiedfinancialdisclosure.TheAccountingCenterregularlyprovidesaccountingstatementsandfinancialanalysistorelevantunits,anduniformlyhandlesfinancialdisclosure.

(2)Thefunctionsofcentralizedaccounting

Accountingcentralizedaccountingisanewtypeofaccountingmanagementmodethatintegratesaccountingservicesandmanagementsupervision.ItsbasicfunctionistoincludeinthecentralizedaccountingunitUnderthecircumstancethattheownership,userightsandfinancialautonomyofthefundsremainunchanged,theaccountingcenterwillactonbehalfofallunitstoperformthefunctionsoffundsettlementandaccounting,andatthesametimeexercisethesupervisionoffinancialfunds.Themethodof"centralizedmanagement,unifiedaccountopening,andseparateaccountaccounting"isadoptedforthefinancialincomeandexpenditureofeachaccountingunit,and"oneofficeoffice,counter-typeoperation"isimplemented.Theincomeandexpenditureofthevariousfundsincludedintheunitshallbeincludedinthebudgetbytheaccountingcenterinstrictaccordancewiththeregulationsandcorrespondingsubjects,andtheunifiedmanagementoffundswithinandoutsidethebudgetisimplemented.Thecentralizedaccountingmodeistoestablishafull-timeaccountingorganization,withprofessionalaccountingpersonnel,usingmodernaccountingprocessingmethodsandscientificandstandardizedaccountingprocessingmethods,tocentrallyhandletheaccountingandsupervisionofvariousunits.Thespecificoperationismanifestedinfouraspects:First,thedecisionmakersoftheaccountingbusinessareseparatedfromtheexecutors,andtheaffiliationoftheaccountantsisalsoseparatedfromtheunit,whichsolvestheproblemoftheaccountants"cannotstanduptostandup,standuptostandup."Fortheproblem,accountingbusinessprocessinghasbeenchangedfromprocessingbyvariousunitstoprocessingbytheaccountingcenter,preventingfraudulentbehavior.Thesecondistheseparationoffinancialapprovalandaccountingsupervision.Aftertheimplementationofcentralizedaccounting,thefinancialapprovalpowerisexercisedbytheunit,andtheaccountingsupervisionfunctionisexercisedbytheaccountingcenter.Thespecificapproversandactualoperatorsareseparated,formingadualrestrictionmechanism.Third,thestorageandmanagementofaccountingmaterialsareseparatedfromtheunit,whichhasfurtherimprovedthesupervisionandcontrolmechanism.Fourth,theaccountingbusinessishandledpublicly.Theprocessingofeachaccountingbusinessmustgothroughatleastsixlinks,includingtheunithandler,financialapprover,accountclerk,andtheaccountingcenterreviewaccounting,bookkeepingaccountingandgeneralaccounting.TheentireprocessingprocessisagainItiscarriedoutundertheoperationmodeof"oneofficeofficeandcabinetgroupoperation",thescopeofknowledgeisexpanded,theoperationprocessisopen,andthe"sunshineoperation"isformed,whicheffectivelycurbsfraudulentbehaviorfromtheoperationmechanism.

(3)Theeffectsofcentralizedaccounting

1.Strengthenfinancialsupervisionandstrengthenthegovernment’smacro-controlcapabilities.Aftertheimplementationofcentralizedaccounting,thebankaccountssetupbyeachunitwerecancelled,andtheaccountingcentersetupbranchaccountsforeachunitinthebank,andreservedunitpaymentseals.Budgetaryfundsareallocatedtothebasicaccountsofeachunitbythegovernment,andextra-budgetaryincomeismanagedby"separaterevenueandexpenditure".Inthepast,decentralizedmanagementbecamecentralizedmanagement.Effectivelysolvetheproblemoftightfiscalfundschedulingandstrengthenthegovernment'smacro-controlcapabilities.Atthesametime,throughthereviewofeachunitoffunds,all-roundandfull-processsupervision,itisensuredthateachfundisusedinaccordancewiththebudgetandproject,whichincreasesthefiscalfunds.Theuseofbenefits.

2.Consolidatetheaccountingfoundationandstrengthentheaccountingsupervision.Theimplementationofcentralizedaccountinghasmovedthepositionoffinancialsupervisionforward.Theawarenessofaccountingunitstoabidebyfinancialdisciplinehasincreasedsignificantly.Manyaccountingclerksoftenasktheaccountingcenterinadvanceabouttherationalityandlegitimacyofeconomicbusinessandtheexpenditurestandardsofrelatedexpenditures,effectivelypreventingmisuseofexpendituresandeffectivelycurbingviolationsoflawsanddisciplines..

3.Promotedthereformoftheaccountingpersonnelmanagementsystemandimprovedthequalityofaccountinginformation.Aftertheimplementationofcentralizedaccounting,thepersonnelrightsandassessmentrightsofaccountantshavebeenseparatedfromtheunit,whichhaschangedthepassivesituationofaccountantsof"standableanduntenable",andstrengthenedaccountingTheindependencefromaccountingsupervisionenablesaccountantstoadheretoprinciples,standfirm,andboldlysupervisetheauthenticityandlegitimacyofaccountinginformation,solvetheproblemsofaccountinginformationdistortionandaccountingdisorder,andgreatlyimprovethequalityofaccountinginformation.

4.Thesuccessfuloperationoftheaccountingcenterhasgreatlypromotedthedevelopmentofdepartmentalbudgetsandgovernmentprocurementreforms,andthein-depthdevelopmentofcentralizedtreasurypayments.Theaccountingcenterprovidesaccurateinformationandbasicdataforthepreparationofdepartmentalbudgets,promptingunitstostrictlyimplementbudgets;atthesametime,itprovidesspaceforthein-depthdevelopmentofgovernmentprocurement.Whereitemsorlaborservicesthatarerequiredtobeincludedingovernmentprocurementareregulatedbytheunit,accountingwillbeconducted.Thecenterwillrefusetopay;iftheunithandlestheprocurementitemsthatarenotincludedinthedepartment’sbudget,theaccountingcenterwillnotbereimbursed.Theaccountingcenterenablesgovernmentprocurementtotrulyseparatethethreepowersofprocurement,useofgoods,andcapitalappropriation.

Latest: Field Programmable Gate Array

Next: Printing house